![]()

How Venice Rigged the First,

And Worst,

Global Financial Collapse

by Paul Gallagher

reprinted from the Winter 1995 issue of FIDELIO Magazine.

![]()

How Venice Rigged the First, And Worst,

Global Financial Collapse

Six hundred and fifty years ago came the climax of the worst financial collapse in history to date. The 1930's Great Depression was a mild and brief episode, compared to the bank crash of the 1340's, which decimated the human population.

The crash, which peaked in A.C.E. 1345 when the world's biggest banks went under, "led" by the Bardi and Peruzzi companies of Florence, Italy, was more than a bank crash—it was a financial disintegration. Like the disaster which looms now, projected in Lyndon LaRouche's "Ninth Economic Forecast" of July 1994, that one was a blowup of all major banks and markets in Europe, in which, chroniclers reported, "all credit vanished together," most trade and exchange stopped, and a catastrophic drop of the world's population by famine and disease loomed.

Like the financial disintegration hanging over us in 1995 with the collapse of Mexico, Orange County, British merchant banks, etc., that one of the 1340's was the result of thirty to forty years of disastrous financial practices, by which the banks built up huge fictitious "financial bubbles," parasitizing production and real trade in goods. These speculative cancers destroyed the real wealth they were monopolizing, and caused these banks to be effectively bankrupt long before they finally went under.

The critical difference between 1345 and 1995, was that in the Fourteenth century there were as yet no nations. No governments had the national sovereignty to control the banks and the creation of credit; or, to force these banks into bankruptcy in an orderly way, and replace fictitious bank credit and money with national credit. Nor was the Papacy, the world leadership of the Church, fighting against the debt-looting of the international banks then as it is today; in fact, at that time it was allied with, aiding, and abetting them.

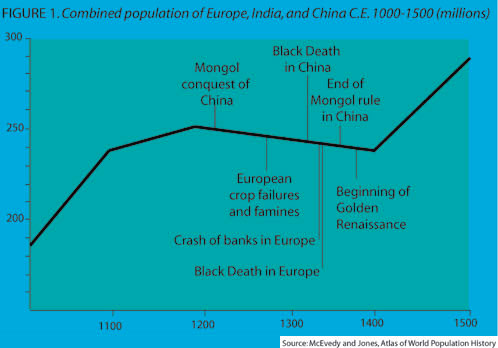

The result was a disaster for the human population, which fell worldwide by something like 25 percent between 1300 and 1450 (in Europe, by somewhere between 35 percent and 50 percent from the 1340's collapse to the 1440's).

This global crash, caused by the policies and actions of banks which finally completely bankrupted themselves, has been blamed by historians ever since on a king—poor Edward III of England. Edward revolted against the seizure and looting of his kingdom by the Bardi and Peruzzi banks, by defaulting on their loans, starting in 1342. But King Edward's national budget was dwarfed by that of either the Bardi or Peruzzi; in fact, by 1342, his national budget had become a sub-department of theirs. Their internal memos in Florence spoke of him contemptuously as "Messer Edward"; "we shall be fortunate to recover even a part" of his debts, they sniffed in 1339.

A "free trade" mythology has been developed by historians about these "sober, industrious, Christian bankers" of Italy in the Fourteenth century—"doing good" by their own private greed; developing trade and the beginnings of capitalist industry by seeking monopolies for their family banks; somehow existing in peace with other merchants; and expiating their greedy sins by donations to the Church. But, goes the myth, these sober bankers were led astray by kings (accursed governments!) who were spendthrift, warlike, and unreliable in paying debts which they had forced the helpless or momentarily foolish bankers to lend them. Thus, emerging "private enterprise capitalism" was set back by the disaster of the Fourteenth century, concludes the classroom myth, noting in passing that 30 million people died in Europe in the ensuing Black Death, famine, and war. If only the "sober, Christian" bankers had stuck to industrious "free trade" and prosperous city-states, and never gotten entangled with warlike, spendthrift kings!

The Real Story

Two recent books help to overturn this cover story, although perhaps that is beyond the intention of their authors. Edwin Hunt's 1994 book The Medieval Supercompanies: A Study of the Peruzzi Company of Florence,* establishes that this great bank was losing money and effectively going bankrupt throughout the late 1330's, as a result of its own destructive policies—in Europe's agricultural credit and trade in particular—before it ever dealt with Edward III. "Indeed, the great banking companies were able to survive past 1340 only because news of their deteriorated position had not yet circulated." Just as in 1995.

And Hunt adds a shocker for the historians, based on exhaustive restudy of all the surviving correspondence and ledgers of the Bardi and Peruzzi. He concludes that their lending to King Edward III was done with such brutal "conditionalities"—seizing and looting his revenues—that his true debt to them may have been no more than 15-20,000 pounds-sterling when he defaulted. Mr. Hunt himself works for an international bank, so he knows how such "conditionalities" of lending work today. He probably knows that the true international debt of Third World countries today is a small fraction of what the banks and the International Monetary Fund claim they owe. He definitely understands that Fourteenth-century England was a Third World country to the Bardi, Peruzzi, and Acciaiuoli international banks. They loaned Edward II and Edward III far less than their promises—but their promises have been dutifully added up as "total loans" by historians, starting with their fellow banker Giovanni Villani.

Even if we accept the highest figures ever given for Edward III's 1345 default against the bankers of Florence, the debt to them of the city government of Florence (which they controlled) was 35 percent greater, and those bonds were also defaulted upon.

More revealing is the latest work of the historian of Venice, Frederick C. Lane, Money and Banking in Medieval and Renaissance Venice.† This work shows that it was Venetian finance which, by dominating and controlling a huge international "bubble" ofcurrency speculation from 1275 through 1350, rigged the great collapse of the 1340's. Rather than sharing the peace of mutual greed and free enterprise with their "allies," the bankers of Florence, the merchants of Venice bankrupted them, and the economies of Europe and the Mediterranean along with them. Florence was the Fourteenth-century "New York," the apparent center of banking with the world's biggest banks. But Venice was "London," manipulating Florentine bankers, kings, and emperors alike, by tight-knit financial conspiracy and complete dominance of the markets by which money was minted and credit created.

As long ago as the 1950's, in fact, one historian—Fernand Braudel—consciously demonstrated that Venice, leading the Italian bankers of Florence, Genoa, Siena, etc., willfully intervened from the beginning of the Thirteenth century, to destroy the potential emergence of national governments, "modern states foreshadowed by the achievements of Frederick II."§ Frederick II Hohenstauffen was the Holy Roman Emperor in the first half of the Thirteenth century, an able successor of Charlemagne's earlier achievements in spreading education, agricultural progress, population growth, and strong government. The great Dante Aligheri wrote his seminal De Monarchia in a vain attempt to revive the potential of imperial government based on Divine Law and Natural Law, which had been identified with Frederick's reign.

Wrote Braudel, "Venice had deliberately ensnared all the surrounding subject economies, including the German economy, for her own profit; she drew her living from them, preventing them from acting freely. ... The Fourteenth-century saw the creation of such a powerful monopoly to the advantage of the city-states of Italy ... that the embryo territorial states like England, France and Spain necessarily suffered the consequences." In addition to what Braudel shows, Venice intervened to stop the accession of Spain's Alfonso the Wise, as successor to Emperor Frederick II.

This triumph of "free trade" over the potential for national government, rigged the Fourteenth century's global human catastrophes, the worst onslaught of death and depopulation in history. It was not until the Renaissance created the French nation-state under Louis XI, one hundred years later, and then England under Henry VII, and Spain under Ferdinand and Isabel, that the human population would begin to recover.

Population: The Fundamental Measure

The clearest measure of the destruction wrought by the merchants and bankers of Venice and its "allies" in the financial crash of the Fourteenth century, is shown in Figure 1. What had been 400-600 years of increasing population growth in Europe, China, and India (altogether, three-fourths of the human population), was reversed. The world'spopulation collapsed. Famines, bubonic and pneumonic plagues, and other epidemics, killed more than 100 million people. Wars, dominated by military slaughters of civilians—as in Rwanda and Bosnia today—raged throughout Eurasia; Mongol armies alone slaughtered between 5 and 10 million people. This depopulation did not begin with the 1340's banking crash, however, although it accelerated after that for nearly a century. The policies of Venetian-allied finance were already reversing human population growth for forty to sixty years before their speculative cancer completely exhausted what it monopolized, bringing on the 1340's rolling crash of all the major banks that had not collapsed earlier.

How did free-enterprise finance, with no government able to control it, collapse all the economies of the Eurasian continent? How could banks concentrated in one part of Europe—tiny on the scale of modern banks—work such a global catastrophe?

See Box I on Population:

Population Grows through Renaissances of Science and Culture

The basis of human economic progress is clear and common to all three great monotheistic religions, as set forth first in the Book of Genesis of the Hebrew Scriptures: "And God blessed them, and God said unto them, Be fruitful, and multiply, and replenish the earth and subdue it" (Gen. 1:28). The human species' uneven progress to fulfill this injunction has taken hundreds of thousands of years; succeeding through scientific renaissances and the creation of cities and great nations through which individuals could make their contributions, to climb from a few million to more than 5 billion people alive today.

History proves that whenever a nation achieves political sovereignty, economic development, individual rights, and general education—Abraham Lincoln's "government of, by and for the people"—its population and population density grows rapidly, even if its inhabited territory expands.

- China's population stagnated at 60 million for eight hundred years (A.C.E. 200-1000), but with the Tenth- and Eleventh-century Neo-Confucian Renaissance of science and the unification under the S'ung Dynasty, the Chinese population doubled in two hundred years, to 120 million by A.C.E. 1200. Then, when China split into three kingdoms and was conquered by the Mongols, its population growth ceased, and its population was only 150 million in 1700: a growth of just 30 million in five hundred years!

- The populations of Egypt, Iraq, Turkey, Syria, and Iran grew rapidly in the Ninth, Tenth, and Eleventh centuries during the great Islamic Renaissance of science, philosophy, and art, when the Caliphates were far more powerful, densely populated, and urbanized than was Europe. Their populations fell when that renaissance of learning was ended in the Twelfth century, leading also to Mongol conquest. These nations only recovered their Eleventh-century population levels in the Twentieth century.

- The Fifteenth-century "Golden Renaissance" of European civilization formed powerful, unified nation-states and set off a population growth which dwarfs all others in human history. The populations of the European nations grew by 10-14 times in five hundred years or so, reaching the highest population densities on Earth.

- But within Europe, Austria's population did not grow with the rest, until the educational and political reforms of Emperor Joseph I at the time of the American Revolution. Thereupon, Austria's population tripled within a century.

- Japan's population was 29 million in 1700, and still only 32 million in 1850; but after the Meiji Renaissance and unification of Japan from the 1860's on, its population surged to 45 million in 1900, 84 million in 1950, and 110 million in 1975.

- India and Pakistan's combined population grew only 50 percent in the Nineteenth century under British colonial oppression, but has nearly quadrupled in the Twentieth century, in which their independence was won.

- The United States' population grew by ten times in one century after the American War of Independence. Speaking of one state (New York), James Fenimore Cooper wrote, "Within the short period we have mentioned (1785-1831), the population has spread itself over five degrees of latitude and seven of longitude, and has swelled (from 200,000) to 2 million inhabitants, who are maintained in abundance. ... Those settlements have conduced to effect that magical change in the power and condition of the State, to which we have alluded." In the 1860's, President Abraham Lincoln confidently expected the U.S. would have 500 million people before the year 2000.

—PBG

A Cancer on Production

In the Eleventh, Twelfth, and into the Thirteenth centuries the growth and development of population both in Europe and particularly in China, was accelerating. China's population doubled in two hundred years during the Neo-Confucian Renaissance of the S'ung Dynasty, to 120 million; meanwhile, the population density of northern France and northern Italy began to approximate the levels these regions have today. As a result of huge increases in the amount of agricultural land productively cultivated, Europe's population had been growing at a steadily increasing rate for seven hundred years up to A.C.E. 1300, following the collapse and depopulation of the Roman Empire from A.C.E. 300 to 600. In addition, there had been several periods in which the rural technologies for using the plow, seed, animal power, water power, and wind power, leaped forward. Classical education of youth in monastery schools (oblates) was spreading up through the Twelfth century, when the great cathedral-building movement arose in France. These advances spread particularly rapidly, owing to the impetus of Charlemagne and his English and Italian allies from 750-900, and then again from 1100-1250, the period of the Hohenstauffen Holy Roman Emperors in Germany, Italy, and Sicily, ending with Frederick II.

But about the turn of the Fourteenth century, the growth of food production and of population stopped in Europe (China's population was already being devastated, on which more below). There were major famines (multiple successive crop failures or extreme shortages) in 1314-17, 1328-29, and 1338-39. One historian concludes that "we gather from [the Italian chronicler] Villani's statements, that a scarcity of more or less severe character put in an appearance about three times each decade. About once each decade the scarcity became so intense, as to assume the proportions of a famine." The most productive rural regions of northern Italy and northern France began to be depopulated from about 1290 onward, while the population of the towns and cities merely stagnated. (The Milan region was a counter-example, owing to aggressive construction of government infrastructure, water-management works, three thousand hospital beds in a city of 150,000, etc.)

The production of wool in England began to decline from about 1310. English and Spanish wool were the basis of European clothing production, although cotton cloth was just beginning to be produced. "In England, beginning with the reign of Edward I (1291-1310) and reaching a climax with Edward III, the Bardi and Peruzzi had acquired a status that gave them a practical monopoly of the procuring and export of wool ... ."

From 1150 onward, the famous Champagne Fairs had been the hub of trading in cloth and clothing, ironwork, woodwork, wool, agricultural implements and food for all of Europe; year-round fairs were held in six cities in the Champagne region around Paris. Merchants had been accustomed to make profits of 3-4 percent annually in hard-cash and goods trading here. The Venetian and Florentine bankers intervened into these fairs with large amounts of credit and bank branches, and with luxury goods "from the East," and took them over. By 1310, an Italian banker from Lucca boasted that he could raise 200,000 French livres tournois in credit on the spot at the Fair of Troyes—but the actual trade in physical goods at the fairs was declining. Hunt's analysis of the successive sets of books of the Peruzzi bank shows that the Florentine bankers expected 8-10 percent annual profit up to 1335. This was far above the rate at which the physical economy of Europe was producing real surplus; in fact, that physical rate of production was falling. The Venetians expected much higher rates of profit still, for reasons outlined below. "At the end of the Thirteenth century, a slowdown in trade hit commodities first; credit operations kept going longer, but the fairs went into severe decline," wrote Braudel.

In the late 1330's, the beginning of the Hundred Years War between England and France led to the clothing industry of Flanders—the main clothing production region of Europe—being boycotted and completely shut off from wool; by the late 1340's, this industry was in complete decline, and was actually moving out of the towns and cities into tiny "cottage industries" in the countryside.

On top of all this, from the 1320's on, there was a "massive flight of silver oltremare["over the sea," that is, to Venice's maritime empire in the Middle East and Byzantium—PBG], which upset the equilibrium of Europe in the mid-Fourteenth century." Venetian exports of silver from Europe from 1325-50 equalled "perhaps 25 percent of all the silver being mined in Europe at that time." Standard silver coin had been the stable currency of the Holy Roman Empire in Europe, and of England, since Charlemagne's time. This massive export from Venice to the East "created chronic balance of payments problems as far away as England and Flanders," and severe problems in making payments in trade. France "was emptied of silver coinage." King Phillip's mintmaster estimated that 100 tons of silver had been exported "to the land of the Saracens" (the Islamic Middle East).

Thus, production of the most vital commodities in Europe had been severely reduced, and the trade and circulation of its money completely disrupted, over the decades beforethe 1340's crash, by Italian banks which appeared to be making usurious rates of profit. "The Florentine supercompanies resembled very closely in their operations the huge international grain companies of today, such as Cargill and Archer-Daniels Midland," writes Hunt. "They used loans to monarchs to dominate and control trade in certain vital commodities, especially grain, and later wool and cloth." Their dominance and speculation progressively reduced the production of these commodities.

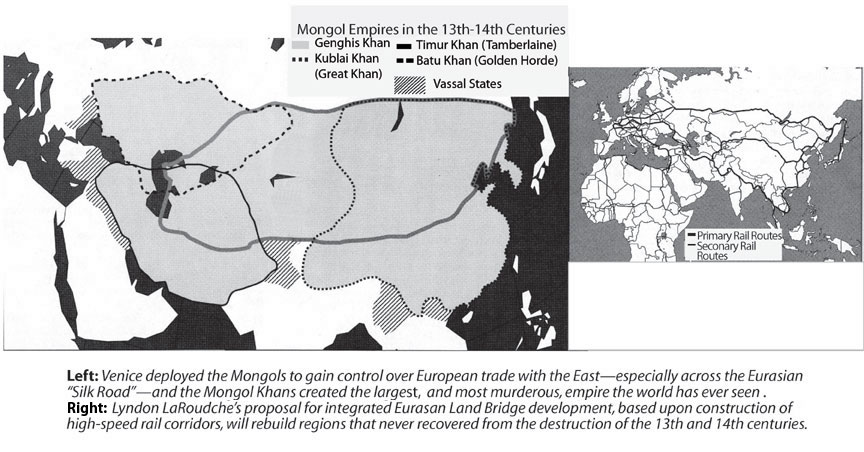

We can see this in more detail, but keeping in mind that the story of the Florentine bankers and the Fourteenth-century crash and Black Death, is itself a coverup. These bankers were operating on an international scale limited to Western Europe and some Mediterranean islands. It was the maritime/financial empire of Venice—and Venice only—which was speculating on the scale of all of the Eurasian landmass; and on this evidence alone, it had to be the merchants of Venice who rigged the devastation and depopulation of the majority of the human race in the Fourteenth century. The Florentine bankers were sharks swimming in Venice's seas. The catastrophe of the Black Death in Europe, so often described, was exceeded by death rates in China and Islamic regions under the homicidal rule of the Mongol Khans from 1250, until nearly 1400. The Islamic chronicler Ibn Khaldun wrote: "Civilization both in the East and the West was visited by a destructive plague which devastated nations and caused populations to vanish. ... Civilization decreased with the decrease of mankind."

Venice was also the "banker," slave market, and intelligence support service for the Mongol Khans.

The Black Guelph

The Bardi, Peruzzi, and Acciaiuouli family banks, along with other large banks in Florence and Siena in particular, were all founded in the years around 1250. In the 1290's they grew dramatically in size and rapaciousness, and were reorganized, by the influx of new partners. These were "Black Guelph" noble families, of the faction of northern Italian landed aristocracy always bitterly hostile to the government of the Holy Roman Empire. Charlemagne, five hundred years earlier, had already recognized Venice as a threat equal to the marauding Vikings, and had organized a boycott to try to bring Venice to terms with his Empire. Venice in 1300 was the center of the Black Guelph faction which drove Dante and his co-thinkers from Florence. In opposition to Dante's work De Monarchia, a whole series of political theorists of "Venice, the ideal model of government" were promoted in north Italy: Bartolomeo of Lucca, Marsiglio of Padua, Enrico Paolino of Venice, et al., all of whom based themselves on Aristotle's Politics,which was translated into Latin for the purpose. The same "coup" made the Bardi, Peruzzi, et al. Black Guelph banking "supercompanies," suddenly two or three times their previous size and branch structure. Machiavelli describes how by 1308, the Black Guelph ruled everywhere in northern Italy except in Milan, which remained allied with the Holy Roman Empire—and was the most economically developed and powerful city-state in Fourteenth-century Italy.

The charter of the Parte Guelfa openly claimed that it was the party of the Papacy, and with Venice, the Black Guelph openly pushed for the Popes to change usury from a mortal sin to a venial (minor) sin. Lane remarks that the Venetians seemed to enjoy an effective exemption from the Popes' injunctions against usury, and also from their ban on trading with the infidel—the Seljuk and Mamluk regimes of Egypt and Syria.

A century earlier, in the 1180's, Doge (Duke) Ziani of Venice had provoked hostilities between the two leaders of Christendom, the Pope and the Holy Roman Emperor, Frederick Barbarossa, the grandfather of Frederick II. Doge Ziani, in time-worn Venetian style, then personally mediated the "Peace of Constance" between the Pope and the Emperor. The Doge got his enemy, Emperor Frederick, to agree to withdraw his standard silver coinage from Italy, and allow the Italian cities to mint their own coins. Over the century from that 1183 Peace of Constance to the 1290's, Venice established the extraordinary, near-total dominance of trading in gold and silver coin and bullion throughout Europe and Asia, which is documented in Frederick Lane's book. Venice broke and replaced the European silver coinage of the Holy Roman Emperors, the Byzantine Empire's silver coinage, and eventually broke the famous Florentine "gold florin" in the decades immediately leading into the 1340's financial blowout—which blew out all the financiers except the Venetians.

Privatization

The Black Guelph bankers of Florence did not simply loan money to monarchs, and then expect repayment with interest. In fact, interest was often "officially" not charged on the loans, since usury was considered a sin and a crime among Christians. Rather, like the International Monetary Fund today, the banks imposed "conditionalities" on the loans. The primary conditionality was the pledging of royal revenues directly to the bankers—the clearest sign that the monarchs lacked national sovereignty against the Black Guelph "privateers." Since in Fourteenth-century Europe, important commodities like food, wool, clothing, salt, iron, etc., were produced only under royal license and taxation, bank control of royal revenue led to, first, private monopolization of production of these commodities, and second, the banks' "privatization" and control of the functions of royal government itself.

By 1325, for example, the Peruzzi bank owned all of the revenues of the Kingdom of Naples (the entire southern half of Italy, the most productive grain belt of the entire Mediterranean area); they recruited and ran King Robert of Naples' army, collected his duties and taxes, appointed the officials of his government, and above all sold all the grain from his kingdom. They egged Robert on to continual wars to conquer Sicily, because through Spain, Sicily was allied with the Holy Roman Empire. Thus, Sicily's grain production, which the Peruzzi did not control, was reduced by war.

King Robert's Anjou relatives, the Kings of Hungary, had their realm similarly "privatized" by the Florentine banks in the same period. In France, the Peruzzi were the cooperating bank (creditor) of the bankers to King Philip IV, the infamous Franzezi bankers "Biche and Mouche" (Albizzo and Mosciatto Guidi). The Bardi and Peruzzi banks, always in a ratio of 3:2 for investments and returns, "privatized" the revenues of Edward II and Edward III of England, paid the King's budget, and monopolized the sales of English wool. Rather than paying interest (usury) on his loans, Edward III gave the Bardi and Peruzzi large "gifts" called "compensations" for the hardships they were supposedly suffering in paying his budget; this was in addition to assigning them his revenues. When King Edward tried forbidding Italian merchants and bankers to expatriate their profits from England, they converted their profits into wool and stored huge amounts of wool at the "monasteries" of the Order of Knights Hospitalers, who were their debtors, political allies, and partners in the monopolization of the wool trade. It was the Bardi's representatives who proposed to Edward III the wool boycott which destroyed the textile industry of Flanders—because by 1340 it was the only way to continue to raise wool prices in a desperate attempt to increase King Edward's income flow, which was all assigned to the Bardi and Peruzzi for his debts! Genoese bankers largely controlled the royal revenues of the Kingdom of Castille in Spain, Europe's other supplier of wool, by 1325.

In the first few years of the Hundred Years War, which began in 1339, the Florentine financiers imposed on England a rate of exchange which overvalued their currency, the gold florin, by 15 percent relative to English coin. Edward III, in effect, now got 15 percent less for his monopolized wool. Edward tried to counterattack by minting an English florin: the merchants, organized by the Florentines, refused it, and he was defeated. By this action, the Bardi and Peruzzi themselves, in effect, provoked Edward's famous default, and demonstrated his complete lack of sovereignty at the same time.

Even the famous account, by banker and chronicler Giovanni Villani, of the default of Edward III that triggered the final crash, acknowledges that his debt to the Bardi and Peruzzi included huge amounts he had already paid—just like the curious arithmetic of the I.M.F. to Third World debtors today: "the Bardi found themselves to be his creditors in more than 180,000 marks sterling. And the Peruzzi, more than 135,000 marks sterling, which ... makes a total of 1,365,000 gold florins—as much as a kingdom is worth. This sum included many purveyances made to them by the king in the past, but, however that may be ... ."

Even larger revenue flows came to the Papacy in the collection of its church contributions and tithes. Under John XXII, the Black Guelph Pope from 1316-1336, "Papal tithes skyrocketted," reaching the apparent value of 250,000 gold florins per year. All were collected by agents of the Venetian banks (for France, the largest source of Papal revenue) and the Bardi bank (for everywhere else in Europe except Germany). They charged the Papacy sizable "exchange fees" to transfer the collections. "Only they [the Venice-allied bankers] had the reserves of cash at Avignon [in France, temporary seat of the Papacy for about seventy years—PBG] and in Italy, to finance Papal operations. They transferred collections from Europe, and loaned them to the Popes in advance." Thus, Venice controlled the Papal credit, and hence the continuing hostilities between the Papacy and the Holy Roman Emperors.

Perpetual Rents

In Italy itself, these bankers loaned aggressively to farmers and to merchants and other owners of land, often with the ultimate purpose of owning that land. This led by the 1330's to the wildfire spread of the infamous practice of "perpetual rents," whereby farmers calculated the lifetime rent-value of their land and sold that value to a bank for cash for expenses, virtually guaranteeing that they would lose the land to that bank. As the historian Raymond de Roover demonstrated, the practices by which the Fourteenth-century banks avoided the open crime of usury, were worse than usury.

In the Italian city-states themselves, the early years of the Fourteenth century saw the assignment of more and more of the revenues of the primary taxes (gabelle, or sales and excise taxes) to the bankers and other Guelph Party bondholders. From about 1315, the Guelph abolished the income taxes (estimi) in the city, but increased them on the surrounding rural areas, into which they had expanded their authority. Thus, the bankers, merchants, and wealthy Guelph aristocrats did not pay taxes—instead, they made loans (prestanze) to the city and commune governments. In Florence, for example, the effective interest rate on this Monte ("mound" of debt) had reached 15 percent by 1342; the city debt was 1,800,000 gold florins, and no clerical complaints against this usury were being raised. The gabelle taxes were pledged for six years in advance to the bondholders. At that point, Duke Walter of Brienne, who had briefly become dictator of Florence, cancelled all revenue assignments to the bankers (i.e., defaulted, exactly like Edward III).

Thus were the rural, food-producing areas of Italy depopulated and ruined in the first half of the Fourteenth century. The fertile Contado (county) of Pistoia around Florence, for example, which reached a population density of 60-65 persons per square kilometer in 1250, had fallen to 50 persons per square kilometer in 1340; in 1400, after fifty years of Black Plague, its population density was 25 persons per square kilometer. Thus, the famines of 1314-17, 1328-9, and 1338-9, were not "natural disasters."

Some of the famous banks of Tuscany had failed already in the 1320's: the Asti of Siena, the Franzezi, and the Scali company of Florence. In the 1330's, the biggest banks, with the exception of the Bardi, (the Peruzzi, Acciaiuoli, and Buonacorsi) were losing money and plunging toward bankruptcy with the fall in production of the vital commodities which they had monopolized, and which their cancer of speculation was devouring. The Acciaiuoli and the Buonacorsi, who had been bankers of the Papacy before it left Rome, went bankrupt in 1342 with the default of the city of Florence and the first defaults of Edward III. The Peruzzi and Bardi, the world's two largest banks, went under in 1345, leaving the entire financial market of Europe and the Mediterranean shattered, with the exception of the much smaller Hanseatic League bankers of Germany, who had never allowed the Italian banks and merchant companies to enter their cities.

Already in 1340, a deadly epidemic, unidentified but not bubonic plague, had killed up to 10 percent of many urban populations in northern France, and 15,000 of Florence's 90-100,000 people had died that year. In 1347, the Black Death (bubonic and pneumonic plague), which had already killed 10 million in China, began to sweep over Europe.

Venice, the World's Mint

"Venice," wrote Braudel, "was the greatest commercial success of the Middle Ages—a city without industry, except for naval-military construction, which came to bestride the Mediterranean world and to control an empire through mere trading enterprise. In the Fourteenth century she was in the ascendant to her greatest periods of success and power."

And most importantly, Frederick Lane writes, "Venice's rulers were less concerned with profits from industries than with profits from trade between regions that valued gold and silver differently."

Between 1250 and 1350, Venetian financiers built up a worldwide financial speculation in currencies and gold and silver bullion, similar to the huge speculative cancer of "derivatives contracts" today. This ultimately dwarfed and controlled the speculation in debt, commodities, and trade of the Bardi, Peruzzi, et al. It took all control of coinage and currency from the monarchs of the time.

The banks of Venice were deceptively smaller and less conspicuous than the Florentine banks, but in fact had much greater resources for speculation at their disposal. The Venetian financial oligarchy as a whole, which ruled a maritime empire through small executive committees under the guise of a republic, centralized and supported its own speculative activities as a whole. The "Republic" built the ships and auctioned them to the merchants; escorted them with large, well-armed naval convoys of their empire, with naval commanders responsible to the ruling "Council of Ten" and the magistrates for the convoys' safety. This same oligarchy maintained several public mints and did everything possible to foster the centralization of gold and silver trading and coinage in Venice.

As Frederick Lane demonstrates, this was the dominant trade of Venice by no later than 1310. Like today's "mega-speculators" in currencies and derivatives, such as the Morgan- and Rothschild-backed George Soros and Marc Rich, the Venetian banks and bullion-dealers were backed by large pools of capital and protection.

The size of the Venetian bullion trade was huge: twice a year a "bullion fleet" of up to twenty to thirty ships under heavy naval convoy, sailed from Venice to the eastern Mediterranean coast or to Egypt, bearing primarily silver; and sailed back to Venice bearing mainly gold, including all kinds of coinage, bars, leaf, etc.

The profits of this trade put usury in the shade, although the merchants of Venice were also unbridled in that practice. Surviving instructions of Venetian financiers to their trading agents in these fleets, specify that they expected a minimum rate of profit of 8 percent on each six-month voyage from the exchange of gold and silver alone: 16-20 percent annual profit.

One astonishing speech to the Council of Ten by Doge Thomasso Mocenigo, from a timeafter the 1340's financial crash, goes further. Compare the magnitude of these figures to those discussed earlier for the Papacy, for England, and for Florence (keeping in mind that the Venetian standard coin, the gold ducat, was roughly comparable to the Florentine gold florin): "In peacetime this city puts a capital of 10 million ducats into trade throughout the world with ships and galleys, so that the profit of export is 2 million, the profit of import is 2 million, export and import together 4 million [from the two annual voyages, 40 percent profit—PBG]. ... You have seen our city mint every year 1,200,000 in gold, 800,000 in silver, of which 5,000 marks (20,000 ducats) go annually to Egypt and Syria, 100,000 to your places on the mainland of Italy, to your places beyond the sea 50,000 ducats, to England and France each 100,000 ducats ... ."

How was this possible? Not by private enterprise, but by imperial Venetian "state usury." The gold from the East was being looted out of China (until then the world's richest economy) and India by the murderous Mongol Empires, or being mined in Sudan and Mali in Africa and sold to Venetian merchants, in exchange for greatly overvalued European silver. The silver from the West was being mined in Germany, Bohemia, and Hungary, and sold more and more exclusively to Venetians with bottomless supplies of gold at their disposal. Coinages not of Venetian origin were disappearing, first in the Byzantine empire in the Twelfth century, then in the Mongol domains, and then in Europe in the Fourteenth century.

The Crusades and The Mongols

The so-called Christian Crusades (the first in 1099, the seventh and last major one in 1291) had had only one strategic effect: expanding and strengthening the maritime commercial empire of Venice to the East. Venice provided the ships to take the Crusaders to the Middle East; Venice loaned them money, and Venetian Doges often told them what cities to try to capture or sack. Through the Crusades, Venice gained effective control of the cities of Tyre, Sidon, and Acre in Lebanon, and Lajazzo in Turkey, and strengthened its domination of commerce through Constantinople. These were the coastal entry-points for the "Silk Routes" through the Black Sea and Caspian Sea regions to China and India. During the Mongol Empires (1230-1370), these routes were virtual "Roman Roads" maintained by Mongol cavalry.

The empire of the Mongol Khans was for a century the largest and most murderous empire in human history [See Box II]. The Mongols eliminated, by slaughter and disease directly in their domains, perhaps 15 percent of the world's population, and destroyed all the greatest cities from China west to Iraq and north to Russia and Hungary—including all the trading cities whose competition bothered Venice. The strategic alliance between Venice and the Mongol Khans, up to and through the financial collapse of the 1340's, has been treated as a historical curiosity of the adventures of Marco Polo's family. But it gave Venice final control of the trade to the East, and along with the trade through Egypt for the gold mined in Sudan and Mali, it gave them huge amounts of gold with which to dominate world currency trading in the decades leading to the financial disintegration of the Fourteenth century.

Box II

The Mongol Empire that Venice Controlled

Although the empire of the Mongol Khans was for a century the largest empire in human history, the Mongols were a people who "had no idea of the social function of a city," according to the historian R. Grousset. "All they knew was to destroy it and massacre its inhabitants. ... The value of agriculture was unknown to [them]. Crops, harvests and farms were burned. Towns were plundered and then destroyed, along with their [infrastructural] works."

In the Thirteenth century, the Mongols' empire conquered all of China, the most populous areas of India, from today's Pakistan west to Syria, all of Russia, Turkey and the Balkans, and eastern Europe. In 1242, they were moving on western Europe when Ogedei Khan died and the Mongol commanders withdrew. The Mongols themselves lived at a very low standard of diet, housing, and productivity, not to mention education and literacy. Their culture allowed only a very low potential population-density—they and their allies on the steppes never exceeded two million in population, and were far outnumbered by their horses, which grazed down huge areas.

The Mongols set out, simply, to impose this low population-density on all the peoples they conquered, taking their wealth and harvests and "culling them down" by massacres, leaving only traders, artisans, military engineers, translators, and others they wanted—usually as soldiers. For example, speaking of Mongol rule in Afghanistan and Iran [Khorassam], the Islamic chronicler Ibn Khaldun wrote: "Towns were destroyed from pinnacle to cellar, as by an earthquake. Dams were similarly destroyed, irrigation channels cut and turned to swamp, seeds burned, fruit trees sawed to stumps. The screens of trees that had stood between the crops and invasion by the desert sands were down. ... This was indeed, as after some cosmic catastrophe, the death of the earth, and Khorassam was never wholly to recover."

The Mongol armies destroyed both the urban infrastructure of cities and the rural infrastructure of agriculture systematically, seeking constantly to seize or create new grassy plains for their great herds of horses. They conquered Syria three times, for example, each time grazing it down in one to two years, and then leaving. Three hundred thousand Mongol horses grazed down the plains of Hungary in two years. Today's environmentalists and anthropologists would call their culture "admirably suited to the sustainable coexistence with their natural environment."

By the time the Mongol armies reached Islamic regions of West Asia in the 1220's, the intelligence service of Venice had reached agreements with the Mongol aristocracy to be their intelligence against courts and rulers all over Eurasia. Under Doge Sanuto and then a second Doge Ziani, Venice instructed the Mongol commanders as to which major cities to destroy, and which to leave alone. At the top of the Venetians' "hit list" were the biggest producing and trading cities on the North-South rivers of central Europe: Kiev and Pest (Budapest). The Mongols completely destroyed these cities, killing their entire populations. Later, a Papal envoy found only a few houses standing in Kiev's location—occupied by Venetian merchants!

The Venetian-Mongol partnership vastly increased slavery on a world scale. The largest trade, involving millions of human beings over more than a hundred years, was the Mongols' enslavement of Russian and South Central Asian peoples they conquered. They depopulated whole areas, selling the conquered through a Venetian monopoly to the North African caliphates and sultanates.

These were the "Mamelukes," who eventually made up the entire army of the Egyptian sultan, for example. Venice was the banker to both the sultan and the Khans. East-West trade had virtually become a Venetian merchants' monopoly, through Mongol and Templar destruction of their competitors.

—PBG

The Mongols, in their genocidal rule of China, looted all the gold of S'ung China and of the part of India under their control, replacing it with silver currency, and for the lower castes (i.e., the Chinese), with paper money. Mongol middlemen met Venetian merchants at the Mongol-ruled Persian trading cities of Tabriz and Trebizond, and the Black Sea port of Tana, and traded gold for silver from Europe. A large-scale trade in slaves from Mongol domains was associated with this currency trading. This was the so-called "tanga gold," from the tanghi or uncoined pieces bearing the seal of the Mongol Khans, as well as bar and leaf gold. The silver was in small Venetian ingots calledsommi, which "were the common medium of exchange throughout the Mongol and Tatar Khanates. ... [T]he demand for silver in the Far East was continually increasing," writes Lane. "The Venetians were able to raise the price of silver despite the existence of record quantities" coming to Venice from Europe.

The Crusades also consolidated the alliance of Venice and its allied Black Guelph-ruled cities, the Papacy, and the Norman and Anjou kings, against the Holy Roman Empire centered in Germany, which Dante and his allies were struggling to restore to its potential. By the late Thirteenth century, the Mongols were a conscious part of this Venetian-led alliance, and the Mongol rulers of Persia even proposed Crusades to the European kings and the Popes! Pope John XXII granted Venice the sole license to trade with the infidel Mamluk sultans of Egypt in the 1330's. This was over-valued European silver and Mongol slaves for gold from Sudan and Mali.

‘Derivatives'

Thus, in the late Thirteenth and Fourteenth centuries, Venice provided all the coinage and currency-exchange for the largest empire in history, which was looting and destroying the populations under its rule. Venice had taken over the currency trading and coining of what remained of the Byzantine Empire, and also of the Mamluk Sultanates in North Africa. Venice, over this period, took the East off a gold standard and put it on a silver standard (it was the richer region of the world, and being more intensively looted). It took Byzantium and Europe off a 500-year-old silver standard and put them on gold standards.

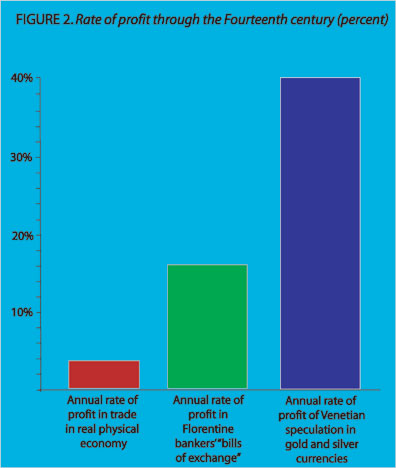

And the Venetian financiers and merchants were making annual rates of profit of up to 40 percent on very large, overwhelmingly short-term (six-month) investments, in a world economy characterized at its most productive, by perhaps 3-4 percent annual rates of real physical "free energy": surplus wealth [Figure 2]. The other Black Guelph Italian bankers' operations were subsumed by Venetian financial manipulations, but they were also realizing rates of profit far above the rate of physical reproduction of the economies of Europe. Because of the dominance of these speculative cancers, all the major real physical economies were shrinking.

What was the effect of this Venetian global currency speculation on the European economies before the 1340's crash and the Black Death? It was the short-term vise that caught the other European bankers and rigged the crash itself.

From 1275-1325, the ratio of the average gold price, to the average silver price, steadily rose, though with continual short-term fluctuations, from about 8:1 to, finally, about 15:1. In this period, Europe's large production of silver was looted through Venice's command of Mongol and African gold. "Venice had the central position as the world's bullion market," writes Lane, "and attracted to the Rialto [Venice's "Wall Street"—PBG] the acceleration of buying and selling stimulated by the changing prices of the two precious metals." From 1290 into the 1330's, prices rose sharply for the most crucial commodities.

In this process of quickening speculation, Venice "ensnared all the surrounding economies, including the German economy" where production of silver, iron, and iron implements was concentrated. By the 1320's, Venetian merchants no longer even travelled to Germany to trade: they compelled German producers and merchants to come to Venice and take up lodgings near the large Fondaco dei Tedeschi ("Warehouse of the Germans") where their goods were stored for sale. Venetian bankers on the Rialto (and Venetian bankers alone in the world at this time) made cashless bank transfers among merchants' accounts, allowed overdrafts, gave credit lines on the spot, created "bank money," and speculated with it. They did this not out of cleverness, but by simple control of currency speculation worldwide: they had the reserves.

In fact, the famous "bills of exchange" of the Florentine bankers, were really a crude form of the "derivatives contracts" of the 1990's speculative cancer. The Bardi et al.charged fees to those involved in trade, for exchanging currencies, since there were so many regional and city currencies. These exchange fees were a cost looted out of all production and trade, and a usurious profit to the bankers. But the banker made the "bills of exchange" even more expensive, to hedge against their own potential losses in currency fluctuations being manipulated by Venetian bullion merchants. Thus bills of exchange in the Fourteenth-century cost 14 percent on average, worse than borrowing at interest (usury).

Venice switched Europe to gold by force of looting silver. England, for example, from 1300-1309 imported 90,000 pounds-sterling in silver for coining; but from 1330-1339, it was only able to import 1,000 pounds. "But in Venice there was no lack of silver at all in the 1330's." The Florentine bankers, with their famous gold florin, enjoyed great speculative profits in this process.

However, from 1325-1345, the process was reversed. The ratio of gold price to silver price, dominated by Venetian manipulation, now fell steadily from the 15:1 level, back down to 9:1. When the price of silver started rising in the 1330's, there was an unusually large supply of silver in Venice! And through the 1340's, "the international exchange of gold and silver greatly intensified again," Lane shows, and there was another wave of sharp commodity price increases.

Now the Florentine bankers were caught, having loans and investments all over Europe in gold, whose price was now falling.

After Venice triggered the fall of gold with new coins in the late 1320's, the Florentines did not attempt to follow suit until 1334 when it was too late; the King of France did not follow until 1337; and last came the pathetic effort of the King of England in 1340, mentioned above.

As Lane shows: "The fall of gold, to which the Venetians had contributed so much by their vigorous export of silver and import of gold, and in which they found profits, hurt the Florentines. In spite of their being the leaders of international finance ... the Florentines were not in a position, as were the Venetians, to take advantage of the changes that took place between 1325 and 1345."

Venetian super-profits in global currency speculation continued right through the bank crash and financial market disintegration of 1345-47 which they had rigged, and beyond.

In the period 1330-1350, the Black Death had spread through southern China, killing between 15 and 20 million people, as the Mongols' looting process came to exhaustion. The Mongols' "horse culture" (they grazed huge herds of horses for hunting and warfare) had destroyed the infrastructure of agriculture wherever they went. It had also moved the population of plague-carrying rodents from the small area of northwest China where it had been isolated for centuries, down into southern China and westward all the way to the Black Sea.

In 1346, Mongol cavalry spread the Black Death to towns in the Crimea, on the Black Sea, and from there it was carried by ship to Sicily and Italy in 1347, and spread throughout Europe. The European population had stagnated for forty years while becoming more concentrated into cities, where water and sanitation infrastructure had decayed. In Florence, for example, all the city's bridges had been built in the Thirteenth century, none in the Fourteenth. Nutritional levels had already fallen as grain production declined. During the Crusades, the practice of Classical education in monasteries had been viciously attacked by the "preacher of the Crusades," Bernard of Clairvaux, and his Cistercian order. In 1225, the Papacy had finally forbidden the presence of young students—oblates—in monasteries. Europe's broadest form of education had disappeared.

After the financial crash and the entry of the plague, Europe's population fell for a hundred years, from perhaps 90 million, to roughly 60 million.

No More Venetian Methods

God allows evil, so that we will become better by fighting it, said Gottfried Leibniz, who founded the science of physical economy in the Seventeenth century. The Black Death in Europe gave the lie to the idea, later popularized by Malthus, that fewer people would mean better life for the survivors—against it, came the Renaissance idea of the dignity and sanctity of each individual life. The chronicler Matteo Villani wrote in the 1360's: "It was assumed, on account of the lack of people, that there would be an abundance of everything the law produces. But on the contrary, because of man's ingratitude, everything was in unusually short supply ... and in some countries there were terrible famines. It was thought there would be a profusion of clothing and of everything the human body needs besides life itself, and just the opposite occurred. Most things cost twice as much or more than they did before the plague, and wages increased disjointedly to double."

The marked price rises in the aftermath of the Black Death and subsequent epidemics, lasted more than a generation. This then led to a sharp deflation and collapse of wages from about 1380.

After 1400, in the years which led to the Golden Renaissance, political forces turned against the methods of the Italian "free enterprise" bankers. In 1401, King Martin I of Aragon (Spain) expelled them. In 1403, Henry IV of England prohibited them from taking profits in any way in his kingdom. In 1409, Flanders imprisoned and then expelled Genoese bankers. In 1410, all Italian merchants were expelled from Paris. When Louis XI became King of France in 1461, he organized national forces to make it the first strong and sovereign nation-state. Along with the development of ports, roads, and support for the cities, Louis XI insisted on a single, standard national currency, created and controlled by the crown. For both Louis XI and England's Henry VII in the same period, "mercantilist forms of economic nationalism were combined with a pronounced hostility to Italian techniques of credit and clearing."

Notes

* Edwin Hunt, The Medieval Supercompanies: A Study of the Peruzzi Company of Florence (London: Cambridge University Press, 1994).

† Frederick C. Lane, Money and Banking in Medieval and Renaissance Venice(Baltimore: Johns Hopkins University Press, 1985.).

§ Fernand Braudel, Civiulization and Capitalism, From the 15th to the 18th Century (New York: Harper & Row).

A former political prisoner in Virginia, Paul Gallagher is the author of "Aeschylus' Republican Tragedies" (Fidelio, Vol. II, No. 2, Summer 1993) and "Population Growth Is Caused by Renaissances" (Fidelio, Vol. II, No. 4, Winter 1993.

![]()

![]()

Disclaimer:

Some material presented will contain links, quotes, ideologies, etc., the contents of which should be understood to first, in their whole, reflect the views or opinions of their editors, and second, are used in my personal research as "fair use" sources only, and not espousement one way or the other. Researching for 'truth' leads one all over the place...a piece here, a piece there. As a researcher, I hunt, gather and disassemble resources, trying to put all the pieces into a coherent and logical whole. I encourage you to do the same. And please remember, these pages are only my effort to collect all the pieces I can find and see if they properly fit into the 'reality aggregate'.

Personal Position:

I've come to realize that 'truth' boils down to what we 'believe' the facts we've gathered point to. We only 'know' what we've 'experienced' firsthand. Everything else - what we read, what we watch, what we hear - is what someone else's gathered facts point to and 'they' 'believe' is 'truth', so that 'truth' seems to change in direct proportion to newly gathered facts divided by applied plausibility. Though I believe there is 'truth', until someone representing the celestial realm visibly appears and presents the heavenly records of Facts And Lies In The Order They Happened, I can't know for sure exactly what "the whole truth' on any given subject is, and what applies to me applies to everyone. Until then I'll continue to ask, "what does The Urantia Book say on the subject?"

~Gail Bird Allen

![]()

![]()