![]()

J.P. Morgan Financial Agents U.S. Civil War Gold Peru Bond

by Unwanted Publicity Intelligence

[ UnwantedPublicity@Gmail.com ]

![]()

Could one woman living in the modest Iowa countryside be the outstanding, primary creditor of the United States and all debtor nations, the real and legitimate owner of the 'Gold Bond Key' to the 'Financial Kingdom'? You bet she could!!

Would the privately owned Federal Reserve, who assumed the Gold Bond debt in the Federal Reserve Act, refuse to pay their obligation when a "Call on the U.S. Debt" was made to the BUREAU OF PUBLIC DEBT? You bet they would!!

Did the Federal Reserve then immediately proceed to set up 'front organizations' and fraudulently use that same 'Gold Bond' as their own collateral? You bet they did!!

A note before you begin:

Everybody always asks the same question when they're told a story they just can't believe, "Where's the proof?"

This report by Unwanted Publicity Intelligence is a deliberately extensive and deeply researched document of proof, validating the legitimacy of "the one time only bonus commodity contract 3392 of April 14, 1875 through April 27, 1875 sold by 'Financial Agents of Peru' HOBSON HURTADO & CO. in New York, New York, U.S.A. on May 1, 1875 with supportive sovereign 'CERTIFICATE OF INDEBTEDNESS OF PERU' number 181 without coupons" owned by Vina Kathryn Durham and currently held within the DURHAM HOLDING TRUST of DURHAM INTERNATIONAL LIMITED, Tias 12087 of Ida Grove, Iowa, USA.

The CIA & West Coast Federal Reserve, through the years of compounding and re-compounding the interest on one 7% side of the Contract for Bonus 3392 from May 1, 1875 to May 1, 1990, calculated at the Locked Bullion Price of $420 per fine troy ounce the staggering amount of $206,858,581,465,280,000,000.00 due and payable in "American Gold Dollars, Gold Coin, Gold, Gold Bullion and/or Coin of the Realm."

This well-known event in the banking world threw the West Coast Federal Reserve Bank computers out of whack and they could not reconcile until mid 1997.

After reading this document and assuring yourself that her claim is legitimate, please visit V.K. Durham's site, The AnteChamber.net, for a full accounting of how every participating government, bank, corporation, non-governmental organization, and criminal agency around the globe bit on the poisoned bait which has resulted in the Economic Crisis we are now experiencing.

June 25, 2010 16:01:09 p.m. ( PST ) [ Updated ]

Introduction

After significant periods of time elapse, facts may become distorted albeit via misunderstanding, innuendo, competition, misinformation, or the rumor mill where - if not corrected swiftly and properly - wild fictional accountings may ensue. Hence, it may not be until after a clear understanding of the facts of yore - no matter how controversial – surface, that truth may eventually be properly recognized. Though thorough research and valiant reporting may discover truth, the greater task of keeping 'truth in plain sight' rests with the public.

Wild fictional accountings ( also known as ) "conspiracy theories" - considered 'totally absurd' by most - can lose even the heartiest of adventurer whose initially valued exciting venture may eventually wane when trying to follow a cornucopia of different pathways to fortune typically provided by others whom have a tendency to lead investor prospects 'completely off the map' but only after investment monies are lost to such curious schemes.

For now, well over a decade, sparked controversy – sometimes extremely vehement - surrounds claims over an 1875 ( then-valued ) $1,000 United States gold plus 7% interest certificate within what appears to be a Peru debt bond that is still being pursued by even the 'map-drawers' themselves - and those behind them - whose groups went so far as to draft and sign a complex maze of entity support documents they arranged filed officially in order to bolster their claims even more over this 1875 $1,000 United States gold "Certificate Of Indebtedness Of Peru" bond ( number 181 ) bearing the exclusive Peru government licensee of financial trading merchant house HOBSON, HURTADO & COMPANY ( New York City, New York, USA ) signed as "Financial Agents of Peru" on the lower left-hand side of the financial instrument.

[ NOTE: View large image of this Peru bond U.S. gold certificate click on the Peruvian Bond above and click the X in the bottom right corner. ]

This Peru guano export trading foreign debt certificate has been claimed - since the late 1980s - by a woman named Vina Kathryn Durham who during May 2003 calculated the 1875 ( then-valued ) United States gold plus 7% interest on any Peru guano export bond – if ever payment was defaulted – could be worth ( according to Mrs. V.K. Durham, in 2003 ) about $6,500,000,000,000 (USD) Trillion dollars.

Although it is believed more than one ( 1 ) such Peru bond certificate was issued, this particular 1875 $1,000 United States gold "Certificate Of Indebtedness Of Peru" bearer bond certificate' - referenced within the text body contents of a five ( 5 ) page document set entitled "American Commodity Contract" signed by "V.K. Durham" ( believed "Protector" over the "Durham Holding Trust" ) – is believed claimed by Mrs. Vina K. Durham as "Property Of Durham Holding Trust," a claim that is believed disputed by at least two ( 2 ) other groups touting their own claim over these certificates too.

This 1875 $1,000 U.S. gold coin payable Peru guano export bond topic has netted a huge internet audience curiosity at online websites like The Rumor Mill News and The Ante Chamber where some - not all - documents and information exist for general public audience review plus information updates surrounding belief strategies from Mrs. V.K. Durham ( Okawville, Illinois ) shared with followers and supporters involved in promoting a complex conspiracy theory pointing at the United States government along with others - believed by V.K. Durham and company to be something more than just 'interested parties' whom are private citizens acting undercover as government co-conspirators afoot to stop, divert, or curtail distribution of wealth to be somehow derived out of this 1875 Peru bond calculated by Mrs. V.K. Durham to be worth nearly $6,500,000,000,000 (USD) Trillion dollars that she wants spent on what she considers to be "humanitarian purposes" contrary to what Big Brother is already using the money for.

V.K. Durham is correct in that the United States government also has its own contention about what it already did surrounding U.S. citizens holding foreign bonds that went haywire long ago.

The U.S. Securities Act of 1933, Title II, saw a provision made for the creation of a Corporation Of Foreign Security Holders (aka) FOREIGN BONDHOLDERS PROTECTIVE COUNCIL INC. to be effective when the United States President "finds that its taking effect is in the public interest, and by proclamation so declares." It was contemplated that the activities of the new corporation ( FOREIGN BONDHOLDERS PROTECTIVE COUNCIL INC. ) would be similar to those of the BRITISH CORPORATION OF FOREIGN BONDHOLDERS ( CFB ) that has an official status in negotiating with foreign issuers.

The Securities Act of 1933 states the corporation ( FOREIGN BONDHOLDERS PROTECTIVE COUNCIL INC. ) shall be created "for the purpose of protecting, conserving and advancing the interests of the holders of foreign securities in default, however, President Franklin D. Roosevelt decided it was not in the public interest to set up a corporation, provided that an adequate private organization could be created instead, whereby the U.S. State Department Secretary, U.S. Treasury Department Secretary and U.S. Federal Trade Commission ( FTC ) Chairman requested formation of the FOREIGN BONDHOLDERS PROTECTIVE COUNCIL INC. in 1933 to negotiate with foreign governments on behalf of American holders for defaulted foreign dollar bonds.

The FOREIGN BONDHOLDERS PROTECTIVE COUNCIL INC. was a private non-profit public service organization whose officers, directors, and members served without pay.

The FOREIGN BONDHOLDERS PROTECTIVE COUNCIL INC. did not act as agent nor enter into any kind of agreement with any bondholder.

Is a lot of research really necessary to sort fact from fiction or is all that simply just not worth the time, trouble, and expense to determine who's right and wrong?

To separate fact from fiction surrounding the controversial 1875 ( then-valued ) $1,000 United States gold coins plus 7% interest in-exchange for a Peru guano export bond, decidedly the best place to begin would be looking into its historical legacy during the 19th Century and gather as much factual information from research and analysis as possible to understand what ( if any ) value the 1875 Peru bond may hold after answering the following five ( 5 ) questions:

1. Which, what, and how historical Peru guano export financial trading merchant house consignment contracts, Peru licensed financial agents, consignees, agents, and export – import shipping contracts were involved that served to impact the status of the 1875 $1,000 U.S. gold "Certificate Of Indebtedness Of Peru" bond?

2. Which, what, and how historical financial institutions were selected paymasters for Peru government guano export financial trading merchant houses ( London, England and New York City, New York, USA ), consignees, and agents that served to impact the status of the 1875 $1,000 U.S. gold "Certificate Of Indebtedness Of Peru" bond?

3. Which, what, and how Peru bonds – held by foreign bondholders – became packaged as assets managed in holdings by other domestic and/or foreign companies and/or financial institutions that may have served to impact the status of the 1875 $1,000 U.S. gold "Certificate Of Indebtedness Of Peru" bond?

4. Which, what, and how Peru bonds were traded or exchanged as United States repayment to the BANK OF ENGLAND for its huge construction loan to rebuild the New York City sewer and water system that served to impact the status of the 1875 $1,000 U.S. gold "Certificate Of Indebtedness Of Peru" bond?

5. Which, what, and how the BANK OF ENGLAND loan to the United States was or is still being repaid interest on that legacy loan to rebuild the New York City sewer and water system that served to impact the status of the 1875 $1,000 U.S. gold "Certificate Of Indebtedness Of Peru" bond?

At the top of the Peru guano export market boom, the 'external debt' of Peru did not alarm much of the rest of the international financial world that saw Peru debt being serviced by only highly reputable "international financial trading merchant houses" exclusively licensed by the government of Peru making them "Financial Agents of Peru."

Prominent international financial trading merchant houses conducted a wide variety of contract related business activities "in-house" where that close knit privacy served to keep competitors outside and uninformed as to the extent and scope of each individual business activity serving to support each contract held by a "House" ( "Company" ).

Interestingly, as a House ( "Company" ) may continue holding contracts by serving-up effective privacy blinds to its competitors, another House anti-competitor blind came unexpectedly via print media companies contacted by friends of competitors whom complained about certain Houses ( "Companies" ) monopolizing international free trade and labor contracts.

Running true to course, creatively written news stories began flairing reports that gave House 'activity and work capacity titles' nick-names that confused readers and politicians whom became blurred as to which House ( "Company" ) was doing what, where, when, and to whom.

Nick-naming House 'activity and work capacity titles', during the 19th Century, served making it difficult to ascertain 'what kind of company' - capable of what type of work activity - was actually being mentioned in news articles where one ( 1 ) company ( "House" ) would eventually be read as being six ( 6 ) companies - all which were never named by the print media.

Although many Houses appeared and claimed to be performing a variety of contract services "in-house," the fact is a variety of services were sent to differently named subsidiary companies inside Holding companies never identified to the public.

International financial trading merchant house 'activity and work capacity titles' became generically known as:

- Merchant Houses ( "House of ..." );

- Consignees;

- Private Banks;

- Financial Agents;

- Securities Houses; and,

- Agents.

International financial trading merchant houses, working in their capacity as a 'private bank', may handle payments to various companies involved in contract support costs ( i.e. import-export costs, ships, crews, skippers, schedulers, traders, merchants, brokers, agents, sales, etc.) for each contract.

International financial trading merchant houses, working in their capacity as a 'securities house', may handle company stock issuance, stock trading, stock dealers, stock certificate traders, etc.

In 1875, international financial trading merchant house ( "House" ) company named "HOBSON, HURTADO & CO." ( New York City, New York, USA ) sold its stock certificates promising repayment in "United States Gold coins" in addition to "7% interest" for anyone holding ( bearer ) such certificates ( bonds ) paid for by money, goods, and/or services for such securities.

At the time these U.S. Gold private securities were sold, transaferred, and/or promised, the company ( "House" ) of HOBSON, HURTADO & COMPANY ( New York City, New York, USA ) signed, guaranteeing repayment of these bearer bonds, claiming they were the "Financial Agents of Peru" contracted by the Peru government issuing its 'exclusive Peru export license' naming "guano" ( sea bird dung, used as fertilizer ) as the Peru product for 'export only to the United States of America import market'.

These foreign individual investors became known as "Peru bondholders," and these private company House securities became known as "Peru bonds."

Before HOBSON, HURTADO & COMPANY ( City Of New York, New York, USA ) went out-of business, all of its financial assets and obligations were turned over to another New York City, New York, USA international financial trading merchant house named "MORTON, BLISS & COMPANY."

When MORTON, BLISS & COMPANY was acquired by merger, all of its financial assets and obligations were turned over to its own established private financial institution named "MORTON TRUST COMPANY."

When the MORTON TRUST COMPANY was acquired by merger, all of its assets and obligations were transferred over to and through a series of yet other periodic mergers and acquisitions ( M&As ) with numerous other financial institutions in New York City, New York, USA that eventually became known ( 2004 ) as the J.P. MORGAN CHASE BANK NATIONAL ASSOCIATION ( see brief below )

- -

New York City Bank Historical Brief -

MORGAN GUARANTY TRUST COMPANY OF NEW YORK, in:

13APR1864 established as: New York Guaranty And Indemnity Company;

01DEC1895 name changed to: Guaranty Trust Company of New York;

26JAN1910 acquired by merger: MORTON TRUST COMPANY;

26JAN1910 acquired by merger: Fifth Avenue Trust Company;

16OCT1912 acquired by merger: Standard Trust Company;

04MAY1929 acquired by merger: Bank of Commerce in New York ( APR 1929 - MAY 1929 );

24APR1959 acquired by merger: J. P. Morgan & Company Incorporated ( 1940 - 1959 );

24APR1959 name changed to: MORGAN GUARANTY TRUST COMPANY OF NEW YORK;

26JUN1959 acquired by merger: Morgan et Cie. (aka) Morgan & Cie. Incorporated (aka) Morgan & Company Incorporated;

27DEC1968 acquired by merger: Morgan Guaranty Safe Deposit Company;

01JUN1996 acquired by merger: J. P. Morgan Delaware;

10NOV01 merged by state as: J. P. Morgan Chase Bank;

13NOV04 converted to federal as: J.P. MORGAN CHASE BANK, NATIONAL ASSOCIATION.

- -

Since at least 1873, before the House of HOBSON, HURTADO & COMPANY became "Financial Agents of Peru," 'predecessor' Charles W. Dabney of the international financial trading merchant House of "DABNEY, MORGAN & COMPANY" held exclusive Peru guano export license contracts as "Financial Agents of Peru."

Both the House of HOBSON, HURTADO & COMPANY and the House of DABNEY, MORGAN & COMPANY were 'New York City', United States of America "Financial Agents of Peru" especially selected for exporting "Peru guano" solely to the "United States of America".

Interestingly, the House of HOBSON, HURTADO & COMPANY was acquired by merger into the MORTON TRUST COMPANY that became acquired by merger into the J.P. MORGAN CHASE BANK, NATIONAL ASSOCIATION in 2004.

Even more interestingly, HOBSON, HURTADO & COMPANY predecessor - the House of DABNEY, MORGAN & COMPANY - was also acquired by merger by the J. P. MORGAN COMPANY.

It wasn't until just shortly after the 20th Century when revelations began surfacing about Peru guano export debt "gold certificates" - paid in United States Gold coins" guaranteeing 'exclusive Peru guano exports shipped directly to the United States only, not exported to U.S. foreign market competitors:

- China;

- Spain;

- Brazil;

- France; and,

- Dutch Antilles.

In 1902, authority Dr. Carlos Weisse provided historical behind-the-scene details for an El Tiempo news reporter covering the Franco-Chilean ( France - Chile ) Switzerland Arbitration Tribunal where Swiss federal judges were positioned by foreign Decrees to decide the outcome of Peru's 'external debt' while foreign creditors, bondholders, and more waited to be paid.

[ UPI REPORT NOTE: One of the companies ( mentioned below ) is quite curiously only known as "Compañía consignataria del guano de los Estados Unidos," which when translated into English, simply means "Company consignee of guano for the United States ). "Compañía consignataria del guano de los Estados Unidos," claims its headquarters was in Lima, Peru. "Compañía consignataria del guano de los Estados Unidos," was represented by Winterthur, Switzerland lawyer Dr. Louis Forrer in front of the Switzerland Confederation Franco-Chilean Arbitration Tribunal . Interestingly, Dr. Louis Forrer was twice president of the Switzerland Confederation. It is believed that the true name of this company ( i.e. "Compañía consignataria del guano de los Estados Unidos," ) - purposely masked by authorities and claoked by other private interests - pertains to the aforementioned highly controversial 1875 then-valued $1,000 United States Gold coins certificate signed by HOBSON, HURTADO & COMPANY was acquired by mergers into companies that eventually became ( in 2004 ) the J.P. MORGAN CHASE BANK, NATIONAL ASSOCIATION. ]

From hundreds of legacy information transcript pages, the following pertinent excerpts ( immediately below ) were selected and translated from Spanish into English to provide additional report information continuity:

- -

Circa: 1902

EL TIEMPO

. . . [ EDITED-OUT FOR BREVITY } . . .

" ... MR. REPORTER: - If it looks good to you, Doctor, begin with the claim of the Company's guano consignees of the United States.

DR. CARLOS WEISSE: - Perfectly. The Company ( 'Compañía consignataria del guano de los Estados Unidos' ) is a company established in Lima, Peru and for this reason has the right to claim Peru citizenship, but its ( 'Compañía consignataria del guano de los Estados Unidos' ) shareholders are of different nationalities, part living in Lima, Peru; and, one ( 1 ) in Italy; and, some in Chile. Additionally, the Company ( 'Compañía consignataria del guano de los Estados Unidos' ) has creditors of a Chilean shipping agent, the Don Carlos M. Lamarca heirs residing in Santiago, Chile.

Before the Switzerland Confederation Franco-Chilean Arbitration Tribunal was established in Lausanne, Switzerland during October 1893, Peru representative ( in Berne, Switzerland ) Don Anibal Villegas managed the affairs relating to its ( Switzerland Confederation Franco-Chilean Arbitration Tribunal ) constitution, and appearing before the Swiss Confederation Franco-Chilean Arbitration Tribunal - while still in session - was Attorney General Don Carlos Lamarca saying the Company ( 'Compañía consignataria del guano de los Estados Unidos' ) is to demand payment of its credits, represented by deposit at the BANK OF ENGLAND, in preference of any other creditor of Peru.

Counsel for the Company ( 'Compañía consignataria del guano de los Estados Unidos' ), was the Swiss Confederation eminent statesman, Mr. Forrer [ Louis Forrer ], former head of the Radical party in Swiss chambers of government, who - after a very laborious political life - retired to private life during 1900, consequence of being rejected by the Swiss people in a plebiscite or referendum law that he worked, unanimously approving court chambers, for poor insurance against illness and accidents for the working class.

The position of the Company ( 'Compañía consignataria del guano de los Estados Unidos' ) was therefore very well taken.

The Company ( 'Compañía consignataria del guano de los Estados Unidos' ) was established toward latter 1865, in order to export and sell on consignment guano to the market of that republic ( United States Of America ), and to advance the Peru government a sum of money on the products ( guano ) of such appropriation ( purchase ).

Under 'Article 16' of the contract, the Company ( 'Compañía consignataria del guano de los Estados Unidos' ) should qne guano export, should sell it only in the United States, and the Company ( 'Compañía consignataria del guano de los Estados Unidos' ) agreed to monitor not selling ( guano ) second ( 2nd ) hand and not exporting ( guano ) to other markets ( China, France, Spain, Brazil, and Dutch Antilles ) designated by the Company ( 'Compañía consignataria del guano de los Estados Unidos' ).

The contract underwent some modifications, from the time Peru government dictator Presidente Prado [ formerly, Colonel Manuel Prado ] who declared void any other company contracts held with Presidente Pezet [ former General Pezet ] during the previous Peru constitutional government, until its conclusion.

During the year 1866 - 1869 Peru held other additional contracts to get larger loans from the Company ( 'Compañía consignataria del guano de los Estados Unidos' ), which also undertook to provide necessary funds to service a loan of $10,000,000 American gold dollars that was launched in 1866 from the New York market with joint guarantees of governments Peru and Chile for their cost of war against Spain. The Company ( 'Compañía consignataria del guano de los Estados Unidos' ) operations was carried out regularly until 1875, amongst actual operations was debt service of interest and repayment on that 1866 loan through Mr. [ Charles W. Dabney ] DABNEY, MORGAN AND COMPANY, financial agents of Peru, and later HOBSON, HURTADO AND COMPANY.

In 1870, the Peru government would free the United States market in appropriation assigned to the Company ( 'Compañía consignataria del guano de los Estados Unidos' ), and to that end would be agreed to receive in payment the balance of its checking account, which then amounted to the sum of $3,600,000 dollars in American gold, a receivable called 'gold certificates', and the government obtained permission to hire a third ( 3rd ) party based on the free ( no tax ) sale of guano in the United States.

That combination failed completely.

The Company ( 'Compañía consignataria del guano de los Estados Unidos' ) appearance on books did effectively service interest and amortization of gold contract licenses on the free ( no tax ) sale of guano was terminated and consequently resulted on balance of July 31, 1893 favor of the Company for $7,000,000 American gold dollars.

This $7,000,000 million dollar balance was liquidated before the Swiss Confederation Franco-Chilean Arbitration Tribunal [ Court of Auditors ] - per Mr. Morales Pegobier - during the constitutional Peru Generals [ Peru General Cáceres and Peru General Bermúdez ] period of time when the Company's [ 'Compañía consignataria del guano de los Estados Unidos' ] new representative, Mr. Forrer [ Louis Forrer of Winterthur, Switzerland ], introduced ( December 30, 1896 ) the Company's [ 'Compañía consignataria del guano de los Estados Unidos' ] claim before the Swiss Confederation Franco-Chilean Arbitration Tribunal without having been made or charged anything for its untimeliness, since as I said at the outset, it even appeared before the final constitution of the Swiss [ Switzerland ] Confederation Franco-Chilean Arbitration Tribunal. ... "

- Carlos Weisse ( July 19, 1902 )

. . . [ EDITED-OUT FOR BREVITY } . . .

- -

In 1902, Dr. Carlos Weisse ( above ) mentioned the international financial trading merchant House of DABNEY, MORGAN & COMPANY ( predecessor of the international financial trading merchant House of HOBSON, HURTADO & COMPANY, "Financial Agents of Peru" ) and Charles W. Dabney ( above ) who was the partner of Junius Spencer Morgan whose J.S. MORGAN & COMPANY was acquired by merger with his son's ( John Pierpont Morgan's ) House of J. P. MORGAN & COMPANY that became the MORGAN GUARANTY TRUST ( bank of J. P. MORGAN COMPANY ), that eventually became ( in 2004 ) the J.P. MORGAN CHASE BANK, NATIONAL ASSOCIATION ( see brief chronology, immediately below, and further above ):

- -

J. P. Morgan & J. S. Morgan Company History Chronology -

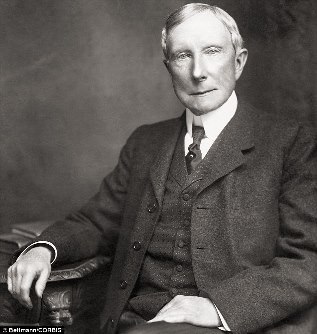

John Pierpont Morgan (aka) J.P. Morgan I ( DOB: April 17 , 1837 - DOD: March 31 , 1913 ) was a New York City, America banker and international financier who - at the turn of the 20th Century ( 1901 ) - was one of the wealthiest men in America;

1857 - 1861, J.P. Morgan worked for Duncan, Sherman & Company;

1860 - 1864, J.P. Morgan was a New York City agent and attorney for George Peabody & Company ( London, England );

1864 - J. P. Morgan's father Junius Spencer Morgan ( DOB: 1813 - DOD: 1890 ) was a partner, of George Peabody, in George Peabody & Company ( London, England ) that became J.S. MORGAN & COMPANY ( London, England );

1864 - When his father ( Junius Spender Morgan ) renamed George Peabody & Company ( London, England ) as J.S. MORGAN & COMPANY ( London, England ), his son ( J.P. Morgan ) lead J.S. MORGAN & COMPANY ( London, England );

1864 - 1871 - J.P. Morgan was a New York City partner, of Charles W. Dabney, in DABNEY, MORGAN & COMPANY;

1869 - 1899 - J. P. MORGAN & COMPANY, merged other banking houses into it, and reorganized many 'railroad companies';

1871 - J.P. Morgan became partner in Drexel, Morgan & Company ( Philadelphia, PA, USA );

1893 - J.P. Morgan became senior partner of Drexel, Morgan & Company ( Philadelphia, PA, USA );

1895 - J. P. MORGAN & COMPANY supplied $62,000,000 million dollars worth of 'gold bullion' supporting U.S. government bonds issued to restore up to $100,000,000 million dollars in fallen gold reserves of the U.S. Treasury;

1895 - J. P. MORGAN & COMPANY became the successor entity, of:

- Drexel, Morgan & Company,

- Drexel & Company ( Philadelphia, PA, USA ),

- Morgan, Harjes & Company ( Paris, France ),

- Drexel, Harjes & Company,

- Morgan, Grenfell & Company ( London, England ), and

- J.S. MORGAN & COMPANY ( London, England ), before 1910;

1902 - J. P. MORGAN & COMPANY purchased numerous England 'ships' ( the Leyland of the Atlantic steamship line ), 'shipping lines', and 'ship companies', eventually became the INTERNATIONAL MERCANTILE MARINE COMPANY, and owned White Star Line - builder and operator - of the ship RMS Titanic;

1912 - U.S. House Of Representatives, Banking and Currency Committee, Subcommittee - led by Mr. Pujo ( known as the "Pujo Committee" ) - found J. P. MORGAN & COMPANY aggregate resources totaled $22,245,000,000 (USD) Billion dollars;

1933 - U.S. Act of Glass and Steagall (aka) 1933 Glass-Steagall Act anti-trust forced the international financial trading and merchant House of Morgan to become separate entities:

1. J. P. MORGAN & COMPANY,

2. MORGAN GUARANTY TRUST ( bank of the J. P. MORGAN COMPANY ),

3. Morgan Stanley ( investment firm ), and

4. Morgan, Grenfell & Company ( international securities firm ).

J.P. MORGAN & COMPANY, the world's first ( 1st ) billion dollar corporation, accomplishments were numerous.

- -

So how does the J. P. MORGAN COMPANY or J. S. MORGAN & COMPANY relate to an 1873 Peru guano export contract and 1875 then-valued $1,000 in "United States Gold coins" bearer bond stock certificate?

In 1862, J.P. Morgan's father ( Junius S. Morgan ) came across a Civil War gold deal involving $2,000,000 million of then-valued "United States Gold coins" and "gold bars" that he and another investor shipped fifty per cent ( 50% ) of - then-valued $1,000,000 worth - to England, an act that created a serious 'gold shortage' in the United States, causing the price of gold to skyrocket, at which point then Junius S. Morgan brought his gold back to the United States where he consequently made a huge profit from his having earlier created an even greater gold shortage in the United States.

Now, what did the controversial 1875 HOBSON, HURTADO & COMPANY bearer bond certificate text read? The certificate specifically states bondholder redemption - of then-valued & $1,000 plus 7% interest - will be in "United States Gold coins!" Is there a connection?

International historical research notes ( further above ) surrounding the Junius Spencer Morgan and John Pierpont Morgan chronology, states:

"1864 - 1871 - J.P. Morgan was a New York City partner, of Charles W. Dabney, in DABNEY, MORGAN & COMPANY;" and,

1869 - 1899 - J. P. MORGAN & COMPANY, merged other banking houses into it, and reorganized many 'railroad companies'."

What ( if any ) "railroad companies" relate to the 1875 then-valued $1,000 plus 7% interest "United States Gold coins" bearer bond certificates for Peru guano exports?

Well, let's begin with the HOBSON, HURTADO & COMPANY ( New York, NY, USA ) agent named THE PERUVIAN CORPORATION LIMITED.

Looking at a very brief area within the official Switzerland Confederation Franco-Chilean Arbitration Tribunal record, we see that THE PERUVIAN CORPORATION LIMITED was in-fact the agent of HOBSON, HURTADO & COMPANY, and appears that THE PERUVIAN CORPORATION LIMITED was mitigating legal claims - on behalf of HOBSON, HURTADO & COMPANY bearer bondholders certificates - before the SWITZERLAND CONFEDERATION FRANCO-CHILEAN ARBITRATION TRIBUNAL during the latter 19th Century and very early 20th Century ( See Official Swiss Federal Court Of Auditors Transcript Excerpts Below )

[ UPI REPORT NOTE: The following pertinent excerpts were translated from French into English, and does not represent all information. ]

- -

SWITZERLAND CONFEDERATION FRANCO-CHILEAN ARBITRATION TRIBUNAL

Reports Of International Arbitral Award Digest Of Sentences Arbitration ( Vol. XV, pp. 77-387 )

20 JAN 1896

10 NOV 1896

20 OCT 1900

08 JAN 1901

05 JUL 1901

CASE OF GUANO ( Chile, France )

. . . [ EDITED-OUT FOR BREVITY ] . . .

1. Until 1869, the Government of Peru operated guano preferably through consignees of which were assigned to separate export departments. The contract of deposits of guano to the United States passed through the ZARACONDEGUI COMPANY and was to end with January 1, 1866, the Government of Peru received, then a system of tendering, tendered BANCO LA PROVIDENCIA, a joint stock company in Lima [ Peru ], and a group of Traders acting on behalf of a company to be. The bidders included calls other guarantees for the repayment of their advances and expenses, that all the guano that Peru will have in the islands or the mainland was specially mortgaged the Company co-signer.

By Decree of October 2, 1865 the Government accepted in various

proposed amendments which were made. The main points settled by the Decree are:

1. Mr. Domingo Porras, in his capacity as general manager and representative of BANCO LA PROVIDENCIA, and his personal name, D. Francisco Bryce, D. Rocas Pratolongo, D. Costa Hermanos, D. Jorge Wallace, D. Pedro Marcone, and Errequeta And Hendebert associated with this effect will be loaded from January 1, 1866 and for 4-years from date of deposit guano that could consume or be consumed during the specified time, the United States of North America and dependencies.

"2. The Houses mentioned above, related to execution this contract, form a company that has the character and will be called:

In French: "Compagnie cosignataire du guano aux Etats Unis de l'Amérique du Nord;" or,

In Spanish: "La cooperación de la empresa-firmante de guano en los Estados Unidos de Norte América;" or,

In English: "The co-signer of the guano company in the United States of North America."

Under the character of that Society [ Company, namely: "The co-signer of the guano company in the United States of North America" ], it is subject to the laws which regulate and guarantee, Peru, contracts and their strict enforcement, it being understood that neither the Company [ "The co-signer of the guano company in the United States of North America" ] nor any Houses that form from the association mentioned above, can recourse if their rights are actually or apparently faulted by Judges and Tribunals of the Republic.

"3. The Company [ namely: "The co-signer of the guano company in the United States of North America" ], undertakes to provide to the public within 60-days from the signing of this Agreement, a thousand [ 1,000 ] shares of the value of one thousand dollars [ $1,000 ] each.

Shareholders will be entitled to benefits and reimbursement of their capital in the same proportions and within the Houses and the people who constitute the Company [ namely: "The co-signer of the guano company in the United States of North America" ], but they will not interfere in the proceedings of this Society, as for recording and it is understood that the headquarters of the Company in Lima [ Peru ].

'16. The guano that is exported under this Agreement will sell only the United States and we will, in agreement with the Government, areas most suitable for consumption, the price will be the most high as possible and will be fixed in agreement with the Government. The Company [ namely: "The co-signer of the guano company in the United States of North America" ] ensure that the article [ guano ] does not traffic in second hand, it not be cheated or falsified and it is not exported to other locations as designated by the consignment.

'20. The Company [ namely: "The co-signer of the guano company in the United States of North America" ] and its employees are subject to all orders and all instructions that the Government will send it relatively costs, the price of guano, the amount that will be exported, and other operations of the business.

'25. In the unlikely event, for any reason, the sale of guano in the United States would not benefit the state, because the price of sale does not suit it, after paying expenses and fresh extraction of guano could be suspended and the Government would be obliged to reimburse the Company [ namely: "The co-signer of the guano company in the United States of North America" ] advances of all kinds it would have made, with interest thereon, and to this end, mortgage today the national pension, and, most especially, quantity of guano necessary that the Company [ namely: "The co-signer of the guano company in the United States of North America" ] would extract.

"26. Neither the Company [ namely: "The co-signer of the guano company in the United States of North America" ] nor its agents will not pledge, or mortgage guano is dependent, or open credit on it, and therefore, the Government will not recognize such commitments, charges, credits or mortgages, as it always reserves the ownership of that guano.

"29. The Company [ namely: "The co-signer of the guano company in the United States of North America" ] agrees to provide the Government an advance on liquid products of the deposit of two million dollars [ $2,000,000 ) per month due to two hundred thousand dollars [ $200,000 ], and it will pay the amount on the first [ 1st ] of the month, the same day that this Agreement be signed.

'32. While the Company [ namely: "The co-signer of the guano company in the United States of North America" ] will not be refunded in full its advances and their interests, the Government will collect only on liquid two [ 2 ] pounds per ton of guano that will sell.

"33. As security for the sums that the Company [ namely: "The co-signer of the guano company in the United States of North America" ] advance now or it could move forward in the future and interests stipulated, the Government specifically mortgage in favor of all the guano that exports bound for the United States and, more particularly:

1. Amount needed to cover the value of its liquid products as are specified, advances and their respective interests, it is understood that, for the aforesaid guarantee, the Company [ namely: "The co-signer of the guano company in the United States of North America" ] will extract only the need for guano consumption a year [ annually ], which will be replaced as and when it has been sold and, to be included in the calculation will be done in this indeed guano deposit, that will be started and one that will be loaded.

Similarly, the Government grants to the Company [ namely: "The co-signer of the guano company in the United States of North America" ], as it will not reimburse the amount of its advances and cover their corresponding interests, the right to continue to enjoy recording in question.2"

On October 7, 1865 in the contract was registered by the notary C. J. Suarez, and signed by the following persons on behalf of the Company [ namely: "The co-signer of the guano company in the United States of North America" ]:

"Mssrs.:

Dominigo Porras, manager of BANCO LA PROVIDENCIA bank [ Peru ],

Costa Hermanos,

D. Rocco Pratolongo,

D. Pedro Marcone,

D. George Wallace,

D. Francisco Bryce,

D. Dominigo Porras,

Errequeta And Hendebert,

[ Whereby ] the [ aforementioned ], were by the nationality of their birthplace / born:

First [ 1st ]: Peru / Peruvian,

Second [ 2nd ] Italy / Italian,

Third [ 3rd ] Italy / Italian,

Fourth [ 4th ] ( not listed in the Swiss Confederation Arbitration Tribunal ),

Fifth [ 5th ] England / English,

Sixth [ 6th ] England / English,

France / French, and others, Traders this place. . ." ( Attorney General Carlos Lamarca, Memoire, Ann. 15. Corp. Doc. No. 146, p. 349. )

2. The Company [ namely: "The co-signer of the guano company in the United States of North America" ] provided for in Article 2 by Decree on October 2, 1865 was formed, notarized by October 17, 1865 and October 19, 1865 under the right:

2. The Company provided for in Article 2 of Decree of October 2, 1865 was formed notarized by the October 17, 1865 and October 19, 1865 under the right:

In French: "Compagnie consignataire du guano pour les Etats-Unis de l'Amérique du Nord,"

In Spanish: "Compania consignataria del guano en Los Estados Unidos de America,"

In English: "Company guano consignees in the United States of America,"

with headquarters in Lima [ Peru ].

[ UPI REPORT NOTE: Interestingly, the Switzerland Confederation Arbitration Tribunal transcript 'name spellings' - provided for this same company - goes beyond just 'word language translations', when the same company name spellings are again but ever so slightly changed yet again. See e.g., company name spelling ( immediately above ) versus ( further above ). For the remainder of this ( UPI ) report, the in-question company name ( referred to, immediately above ) will - from now on - be referred to, as: "Company guano consignees in the United States of America," unless otherwise noted in this UPI report.]

3. The war broke out between Spain - on the one hand - and Peru, Chile, Ecuador and Bolivia on the other hand.

The governments of Peru and Chile came together to jointly contract a loan of ten million [ $10,000,000 ] American gold. The interest was stipulated at 7%, capital refundable shift to maturities between July 1, 1871 and July 1, 1874. Emission of a partial amount of two million dollars [ $2,000,000 ] in bonds of $1,000 and $500, was undertaken.

- -

Superscript note(s):

1. The Company's [ "Company guano consignees in the United States of America" ] agent [ THE PERUVIAN CORPORATION LIMITED ] offers the following translation, "...and any precise amount to cover the value of its liquid products as specified advances and their respective interests."

2. The Company's [ namely, "Company guano consignees in the United States of America" ] agent [ namely, "PERUVIAN CORPORATION LIMITED" ] has said, " ... special law ... New York July 30, 1866. Sales rose to $1,535,000 dollars.

- -

The general obligation debt, reproduced on the right, wearing among other provisions:

"CLAUSE 7. In addition, the public faith, commitment by the Republics of Peru and Chile, and the general mortgage of all national revenues for safety and service that debt, the Government of Peru mortgage specifically to ensure repayment of interest and amortissement, 500,000 tons of Peruvian guano of the Chincha Islands and provides each holder of the warrants, or his legal representative, the right to take possession guano above in sufficient quantity and at that price 25 dollars in gold per ton..." ( Consignee [ namely, "Company guano consignees in the United States of America" ]. Memoire I, Ann. 9, p. 43, Ann. 10, p. 47. Corp.. Doc, No. 78, p. 149. )

4. At the end of the first ( 1st ) coupon interest on the loan, the Company [ namely, "Company guano consignees in the United States of America" ] assumed the obligation to pay the amount, and to cope with subsequent deadlines, its advances on this account to bear interest at 10%.

5. In 1869, the Company [ namely, "Company guano consignees in the United States of America" ] demanded that the Government compensation injury it had sustained by the fact that, unlike provisions of Article 27 of its contract, the agents [ THE PERUVIAN CORPORATION LIMITED ] had not not delivered the guano deposits existing in December 31, 1865 and the fact that the State, in violation of the contract of October 7, 1865 had treated [ contracted ] with a third [ 3rd ] party to sell 20,000 tons of guano in the United States.

Satisfaction was given to the Company [ namely, "Company guano consignees in the United States of America" ] on these two [ 2 ] points by an Agreement reached April 20, 1869 in the form of a Decree rendered on that date, recorded November 5, 1869 of that year, which states that:

"The co-signer of the guano company in the United States has the right to export and sell, in compensation of twenty thousand [ 20,000 ] tons of guano imported into this market by "MOORE," and those which it has been private, unlike the agreements made in the contract recording … And who are all in the amount of thirty thousand [ 30,000 ] tons of guano, an amount equal to the latter to be regarded as additional those who sell during the contract. - Take this Order as completion of the above agreement and deposit the same conditions as it." ( Attorney General Carlos Lamarca, Memoire, Ann. 16, p. 11-12. )

6. On December 1, 1869 the Company sent the co-signer Government of Peru the following proposals:

"1. The Company [ namely, "Co-signer of the guano company in the United States" ] deposit of guano in the United States undertakes to pay the tax credit, as an advance on the net proceeds of guano, the sale of which is dependent, the sum of two million [ 2,000,000 ] soles in the following form:

"Soles 800,000 in up to 30-days after approval of this Convention.

"Soles 1,200,000 in monthly assessments and successive soles 200,000

each.

"2. The Company [ namely, "Co-signer of the guano company in the United States" ] will reimburse the sums it has paid according to the previous article and interests, applying therefor, but no profit on foreign exchange, trading or commission, the amount necessary of the net accounts guano later sold to United States, less prior to a premium of 4% on that net proceeds that the Company [ namely, "Co-signer of the guano company in the United States" ] will charge in future accounts sales reported to the Government.

"The amounts paid by the Company [ namely, "Co-signer of the guano company in the United States" ] under this Agreement it will produce a 5% interest per annum and the same rate of interest Government will be acquired on the net proceeds of guano sold fortnight [ in 2-weeks ] to fortnight [ in 2 weeks ], after deducting the premium for the benefit of the Company [ namely, "Co-signer of the guano company in the United States" ] as stated in the previous article.

"4. The Government grants and warrants to the Company [ namely, "Co-signer of the guano company in the United States" ] possession and the continuation of the exclusive right to export guano and sell it to the United States of America until the amount of 200,000 tons register. It stipulated and agreed that the duration of the contract recording the Company [ namely, "Co-signer of the guano company in the United States" ] celebrated with the Government for export of guano and sales in the United States remains determined and committed to the time that is necessary and enough to export and sell in that Country [ United States of America ] the amount of 200,000 tonnes indicated, is changed in these terms what had been ruled by the Decrees of December 16, 1865 and April 20 on the duration of the Contract deposit.

These proposals were greeted with some modifications by the Decree below dated December 16, 1869:

" ... supply that is home to a co-signatory states of guano - States of North America - taking into consideration that because of several orders of arrest on charter prevented the Company's agent selling any quantity of guano that during the period of its contract would have realized - that this decrease in sale reduced profits on which the Company [ namely, "Co-signer of the guano company in the United States" ] could reasonably starting when it signed its recording contract - it is just this loss of profits - the only way to provide compensation due without prejudice to the State [ Peru ], is give it the right it will sell a fixed quantity of tons in this way replacing the time it wants to the expiration of its contract soil until the end of the year 1871 - in over the dealership last April to sell after this term 30,000 tons register - considering also that the said Company [ namely, "Co-signer of the guano company in the United States" ] Government offers two-million [ 2,000,000 ] soles under very favorable conditions for the Treasury - in the general budget, Republic has not considered the amortization of goods that is now or what is owed to the Government of Chile for maintenance of the Peru squadron on whose behalf it will pay promptly the amount of $450,000 - or other disbursements equally indispensable and urgent as those which increase significantly the budget deficit and force the Government to obtain the resources; agree with the vote of the Advisory Council Ministers and by using the options given by the Government Act of January 25, 1869 and its legal powers, it is said:

"1. That the Company's [ namely, "Co-signer of the guano company in the United States" ] agent [ PERUVIAN CORPORATION LIMITED ] guano to the United States America has the right to export to this market of 200,000 tonnes registry of guano, and the exclusive right to sell the guano on the market to placement total tons reported.

"2. The export of 200,000 tons register will start to count from the first [ 1st ] vessel [ ship ] that the Company [ namely, "Co-signer of the guano company in the United States" ] will ship [ send ] after the date of this Agreement.

"3. The Company [ namely, "Co-signer of the guano company in the United States" ] will undertake the export and sale in accordance conditions of contracts in force between the Government and itself.

"4. The Company [ namely, "Co-signer of the guano company in the United States" ] will advance to the Government the sum of two million [ 2,000,000 ] soles, either:

$800,000 dollars to pay to the Tax Department, and the 30-days from the date of this Agreement notarized, and 1,200,000 remaining in $200,000 monthly payments each.

"5. The Company [ namely, "Co-signer of the guano company in the United States" ] disclaims any commission or exchange treats two million [ 2,000,000 ] on the soles of its advance.

"6. To advance, the Company [ namely, "Co-signer of the guano company in the United States" ] will not charge beyond 5% interest per year.

"7. The Company [ namely, "Co-signer of the guano company in the United States" ] will enhance the Government's current account interest of 5% on net sales in time and prepared form.

"8. The student government at the 5% sales commission from that date to the depletion of 200,000 tons register, subject to this Agreement.

"9. The repayment of $2,000,000 dollars that the Company [ namely, "Co-signer of the guano company in the United States" ] advance and payment of interest and the sales commission will be with the net proceeds of the guano deposit which is placed in the hands of the Company [ namely, "Co-signer of the guano company in the United States" ] plus the sale of 200,000 tonnes, subject to this Agreement.

"10. In addition, $2,000,000 dollars, the Company [ namely, "Co-signer of the guano company in the United States" ] engage to fill funds to service the Peru - Chile debt to the United States in that the disposal of the Government, which will send its instructions.

"11. Remain in force the existing contracts between the Government and the Company [ namely, "Co-signer of the guano company in the United States" ] without changes other than those resulting from this contract in respect of advances, repayment, exchange, commission sales and deals and duration 1 and the period of time mentioned." ( Consignee, Memoire, Ip 53, Sch. 14. Body. Doc. No. 148, p. 358 et seq. ).

7. To clarify the scope of commitments it would take and "Remove any doubt in the future, the Company [ namely, "Co-signer of the guano company in the United States" ] asked December 20, 1869, the Government prior to bond, to take note of the fact that" the only duty of the Company [ namely, "Co-signer of the guano company in the United States" ] following the Supreme Resolution of December 16, 1869 is to provide funds for the payment of interest of that debt during the time that the Company [ namely, "Co-signer of the guano company in the United States" ] remains in possession of the exclusive right to sell the guano on the market of its deposit.

The same day, December 20, 1869 it was ruled as follows on this application by the Minister of Finance:

"Considering the present demand ... it is said:

"The Company [ namely, 'Co-signer of the guano company in the United States' ] has not, as to service the debt Peru - Chile obligation other than to provide the funds necessary to pay only interest of this debt, that obligation will remain only during the time it will retain possession of the right of sale of guano in that country [ United States of America ]."

The contract, consisting of the earlier acts, including the application and the Decree of December 20, 1869 was registered December 22, 1869 by Notary Public C.J. Suarez.

- -

superscript note:

1. In its third ( 3rd ) memoir, P. 38, the Company [ namely, "Co-signer of the guano company in the United States" ] has an agent [ PERUVIAN CORPORATION LIMITED ] version a little different from it being the "duration of sales," inter alia "Dauer der Verkaufe" ( Ventos ). The PERUVIAN CORPORATION LIMITED translated it into, "the duration of the monopoly."

- -

8. Notwithstanding the positive clarification provided by the Decree of December 20, 1869 the Government claimed the Company [ namely, "Co-signer of the guano company in the United States" ] in the current year 1871, the disbursement of funds as the amortization that serve the interests of the Peru - Chile Debt.

This requirement was based on the terms of Article 10 of the Supreme Decree of December 16, 1869.

The obligation of the Company [ namely, "Co-signer of the guano company in the United States" ] to service the interest was, the Government said, well before the December 16, 1869 agreement: Clause of Article 10 of Supreme Decree had no reason to be, if it had not shut the obligation of providing for depreciation, also implied in a manner specified by the term "debt service 'in the Order.

As for the clarification provided December 20, 1869, it had no value or binding, because it could not depend on the Minister of Finance, that this statement came to depart from the Supreme Decree of December 16, 1869 or make changes, rather than introducing a new clause in the contract formed by the Company [ namely, "Co-signer of the guano company in the United States" ] proposal on December 1, 1869 and the Decree of December 16, 1869.

Based on these considerations, and to overcome the resistance of the Company [ namely, "Co-signer of the guano company in the United States" ], the Government on May 21, 1871 made a Decree concerning:

"That the Company's [ namely, "Co-signer of the guano company in the United States" ] agent [ PERUVIAN CORPORATION LIMITED ] is obliged to faithfully execute the order and immediately forwarded by the Directorate annuities as of yesterday to provide funds necessary for the service Chile amortization of Peru goods drawn on April 1, [ 1871 ] and must be repaid on July 1 [ 1871 ].

"In the event that the Company [ namely, "Co-signer of the guano company in the United States" ] refuses to execute this order, the Agreement in December 1869 is declared null and void.

"This Act will be brought to the attention of the Company [ namely, "Co-signer of the guano company in the United States" ] order to select one of the two [ 2 ] solutions as proposed." ( Attorney General Carlos Lamarca, Memoire, Sch. 11. Corp., Doc. No. 149, p. 363. )

Placed in the alternative that was offered by the Decree, the Company [ namely, "Co-signer of the guano company in the United States" ] requirements are submitted to the Government, and took charge of depreciating the Chile - Peru debt.

As of July 1, 1873, it was back in possession of 1,569 loans for the 1866 purchase, with coupons representing a capital value in $1,535,000 million United States Gold.

9. On April 15, 1875, the Peru Congress [ el Congreso del Perú ] passed a law authorizing the President of the Republic [ Peru ] to proceed to the open sale of 200,000 tons of guano to the United States market in North America and for those who currently have those states with guano necessary measures to end its contract." ( DREYFUS, Doc. No. 254, fasc. IV, p. 456 ).

10. For the effect of allowing, under this Act, the guano accountant living in the United States to adjust the position of the agent [ PERUVIAN CORPORATION LIMITED ] of the company [ namely, "Co-signer of the guano company in the United States" ], the government has spent with this consignee company [ namely, "Co-signer of the guano company in the United States" ], April 24, 1875, a final agreement - recorded May 7, 1875 by the notary C.J. Suarez, whose main provisions are:

"ARTICLE 1. - Guano company [ namely, "Co-signer of the guano company in the United States" ] executive in the United States is abandoning the exclusive priviledge its contract gives on December 16, 1869 for export and sale of guano in the United States of America and waiver in part and in the manner specified below, the right to be reimbursed for the claim against the Government by all guano products sold for consumption in the United States of America. The Government therefore is free to exercise their right to freely sell the guano, elements of the faculty is given by the legislative decision April 16, 1875."

"ARTICLE 2. - The Company [ namely, "Co-signer of the guano company in the United States" ] will continue selling the guano consignment exported and export remains according to their contract as follows:

The existing guano deposits to the United States, to which are en route to that Country [ United States ], and whomsoever is responsible or whomsoever should cause to be be loaded on vessels chartered for that date by the Company [ namely, "Co-signer of the guano company in the United States" ], will sell such trying to achieve that rapidly. The rest of guano, the Company [ namely, "Co-signer of the guano company in the United States" ] should export, will be exported and sold by the Company [ namely, "Co-signer of the guano company in the United States" ] within suitable timeframes and in such quantities sufficient enough for half a semester with punctuality service 'Debt Certificates' that will be discussed further, and in addition to payment fee of diplomatic staff, consular staff, the Inspector Treasury of the United States of America, and any obligation currently resulting from the implementation of this Convention. It is stipulated that ships in the future will be loaded by the Company [ namely, "Co-signer of the guano company in the United States" ] with guano, according to this convention, it has the right export, discharge their cargoes in the ports of New York [ New York, United States of America ] and Baltimore [ Maryland, United States of America ] only."

"ARTICLE 4. - By calculating approximately four million ( 4,000,000 ) soles balance that the Government should at the Company's current account, with ten percent ( 10% ) interest on April 30, 1875, the Government is committed to issue and deliver to the Company, "Certificates Of Indebtedness" of $1,000 dollars each, in United States Gold coins, for a total nominal value of three million six hundred thousand dollars [ $3,600,000 United States Gold coins ], which at the rate of ninety percent ( 90% ) is credited to Government account running May 1, 1876. The changes which will be calculated the value of such certificates will be set conventional and whomsoever served for parties of debit and credit account current aforesaid."

"ARTICLE 5. - The certificates [ "Certificates Of Indebtedness Of Peru" ] mentioned in the preceding article shall be issued, and their service will be established within the City of New York. They generate interest on the nominal value in gold [ United States Gold ] at a rate of seven per cent ( 7% ) per annum, payable half-yearly ( every 6-months ) matured, and they will be amortized in the following proportion:

Ten per cent ( 10% ) of the principal, at the end of the first ( 1st ) year, counting from the date of their issue;

Fifteen per cent ( 15% ) of the principal, at the end of the second ( 2nd ) year, counting from the date of issuance;

Twenty per cent ( 20% ) of principal, at the end of the third ( 3rd ) year, counting from the date their issuance;

Twenty-five per cent ( 25% ) at the end of the fourth ( 4th ) year, counting from the date of issuance;

Thirty per cent ( 30% ) of principal at the end of the fifth ( 5th ) year, counting from the date of issue;

The debt payment, which should apply these certificates from advances made in earlier periods, under Contracts made from millet eight hundred sixty-five [ 865 ] until eighteen hundred six ( 1806 ) anteneuf, with mortgage that would sell for United States of America guano consumption, the same guarantee, and is still assigned to the Payment Certificates which represent up to its total extinction, and therefore, the product of guano, which is exported to the United States remains determined as guarantee funds for the service of such certificates, with preferential rights any other object."

"ARTICLE 6. - Officers of the Company in New York will finance officers Peru for the effects of the issuance and service certificates to their full payment. These agents will have their account for the costs of printing certificates, and other costs required by their Program and their service. In return, they will receive the commission which will be supplied charged to the Government, two and a half per cent [ 2-1/2% ] on the amount of certificates to be issued, and Committee financial officers will also receive the Government used a percent on the interest they will pay each semester and a half per cent [ 1/2-% ] on the value of certificates which will be amortized each year.

"ARTICLE 9. - If by some circumstance the proceeds of the Company to export guano and sell on consignment could not cover the annual service of certificates to be issued for the sum three million six hundred thousand dollars [ $3,600,000 million (USD) ], it will take preference to any other be the amount required for this product direct sales and free guano, giving the Company in such sale for the party wanting the same right of administration granted to it, according Article 6, and it is stipulated that if before the amortization of all certificates, it leaves the system counter and direct guano which is consumed in the United States, and we adopt a different system, the Government will arrange so that in any Contract, which will be made to the flow of the guano, the Concessionaire Contracts not only with the Government, but also with the certificate holders [ bond holders ], duty expressly provide timely funds necessary for Coupon V payment amortissement such certificates for the part that happens not be covered with the proceeds of guano that the Company should export and sell, and for this purpose it will export and sell."

"ARTICLE 13. - As soon as the Company shall have received certificates which are the subject of this Convention, it may jeopardize or engage in guano exports or it will be entitled to export for an amount not exceeding the aggregate amount of balances which the Company is a creditor in its general account with the Government, and in the Charters and expenses incurred by guano, and any mortgage or charge which the guano and that any time whatsoever exceed the aforesaid amount of balances, shall be null and void to the extent of its surplus."

"ARTICLE 14. - On account of the proceeds of guano that the Government can charge counter and direct the company advanced it one hundred thousand pounds ( 100,000 British Pounds Sterling ), ten ( 10 ) payments of ten thousand pounds ( 10,000 British Pounds Sterling ) each, payable the thirteenth ( 13th ) and twenty-seventh ( 27th ) for five ( 5 ) months of this year [ 1875 ] in good bills on London [ BANK OF ENGLAND ] 90-days of order. The Company will charge the Government on a special amount of such acceptances, value day in Lima [ Peru ] respective letters in London it will be given by calculating the change the fixed type and nominal forty-four ( 44 ) peniques by Sol and will also receive a commission drawing of one per cent [ 1% ] it will debit the same account."

"ARTICLE 16. - While the Company will not be reimbursed for the value of acceptances for the sum of one hundred thousand pounds [ 100,000 British Pounds Sterling ] which is mentioned in Article 14, and its interests and commissions, the Company will be responsible for the administration of prescription and it will arrange with buyers and receive them the total amount of guano they buy, all in accordance with Government instructions. This intervention of the Company ceases once it has been repaid in advance of a hundred thousand pounds ( 100,000 British Pounds Sterling ) with interest and commission. To reward the services of the Company in the administration of non-prescription guano, it is granted a commission of two and a half per cent [ 2-1/2% ] on the total value guano to be sold OTC ( Over The Counter ) through its intervention."

"ARTICLE 18. - Have always force strength and the terms of contracts, the Company has entered into with the Government, and other decisions in force in as they are not contrary to the express provisions of this convention, and it is said that part of the debt of the Company took the form of Certificates will in no time be regarded as the effects of such contracts, as having made the payment or extinction of that government debt, except for the portion thereof that represents the value of certificates actually depreciated." ( Attorney General Carlos Lamarca, Corp., Memoire, Doc. No. 150, p. 363, Sch. 19. )

11. The 3,600 debt certificates provided for in Article 4 were actually issued by the Government to the Company. It paid its Committee officers on 21 / 20 / 0 under Article 6 of the Agreement of April 24, 1875 and May 7, 1875 but kept the certificates by devers it.

The Company credits first [ 1st ], the Government's total, then recited successively each maturity, the amount of depreciation that should have place and interest.

12. Next extract accounts of the Company controlled and certified by the Accounting Section of the Ministry of Finance, issued sample by the Head of the Archives of the Court of Accounts, the amounts paid by the company "to withdraw from circulation the vouchers Péru-Chiliens" amounted to $2,800,004.56 dollars on May 31, 1875.

The total net creditor of the Company on said date ascending from the same extract at $3,624,544.97 dollars. ( Attorney General Carlos Lamarca, Memoire, Sch. 13. )

13. The operations of the Company came to an end in July 1881, but because of the war with Chile and other circumstances, the liquidation final accounts was completed in 1893.

In 1890, the Company, by the body and its main creditor attorney, Carlos Lamarca, made with the Government of special departments for a settlement that allowed him to participate in distribution of money appropriated to the satisfaction of Peru creditors by the Chile Order of February 9, 1882 and subsequent acts.

In a report submitted July 24, 1890 the President of the Republic, Minister of Finance made findings adverse to the contention Company, the Minister observed that judgments about Auditors of the Company are not enforceable, "it gave off any sum payable liquid" and "hence, on the other hand," the Company had for all debts that it could be recognized the final disposition, other than the mortgage that guano would be exported and not a lien on any existing guano, that consequently, its claim was not based on the guarantee of guano." ( DREYFUS, doc., fasc. IV, p. 439 ).

These findings were adopted by the Government which made the July 25, 1890 following the Order ( dated in error "25 Junio" in the Peru language )

"Given the discussion above of the Minister of Finance and Commerce, report of the High Court of Auditors, which said this presentation it refers, and other backgrounds who see the current status of accounts relating to the deposit of guano in the United States, and demonstrate that the claim to which the request relates to the Company's agent is not supported on the security of guano, it is resolved:

Shall be declared inadmissible the complaints made on May 14, 1875 and May 19, 1875 by the last representative of the Company's guano agent ... " ( Lamarca, doc. Corp., No. 151, p. 369.; and, Dreyfus. Doc, No. 191, fasc. II, p. 86. )

14. The Company co-signer, does not consider this decision as irrevocable, the Government sent the August 23, 1890 and September 25, 1890 two ( 2 ) new requests "reconsideration pidiendo of the Supreme Decree of July 25, 1890." ( Mem. Attorney General Carlos Lamarca, Sch. 8 and Sch. 9. )

The Government took the view that both the Attorney-General to the Peru Supreme Court, which concluded that the revocation of part of the Order of July 25 ( quoted above ) on the guano guarantee:

"If, says report of the magistrate, the general liquidation of accounts recording, we must draw after all the trials have been tried, it result was a balance in favor of the consignees, the balance would have a mortgage on the guano for, first, the company has been forced - contrary to the terms of his contract - to provide for depreciation the loan of 1866 must be considered subrogated all rights and guarantees attached to the warrants that it has repaid in accordance to Article 2234 Civil Code of Peru, on the other hand Article 33 Contract of 1865 - giving the company the right to pursue export guano in the United States until its extinction - claims for advances and interest, it is logical to assume that export ceased without the Company having on hand guano sufficient to cover existing in the guano deposits and that had to carry the United States during the term of the obligation is legally and specifically mortgaged to the execution of this Agreement."

15. In the light of this report, the President of the Republic went on September 19, 1892 the following Decree:

"Given the document in which the Company's agent guano the United States seeks the amendment of Decree official June 25, 1890, which states that the claim that the Company requires cons the state is not liquidated and is not consolidated by the guarantee of guano, and taking into account: ...

2. That both the subrogation effected, when the Company consignee of guano to the United States to order withdrawn by the Government purchase borrowing Peru - Chile 1865, than the terms this issue and Clause 25 and Clause 33 of the Agreement of October 7, 1865 and Clause 5, Clause 9, and Clause 18 of the Agreement of 1875, it is undeniable without injustice clear that the advances that the petitioner Company has made to the Government, have come true, relying on the guarantee guano until full payment; agreement at any point with the Report of the Prosecutor of the Superior Court of Justice which arguments are shown enclosed, and with the vote of the Council Ministers.

It is said that the balance that may arise in favor of the Company consignee of guano in the United States, the final disposition of accounts with the Government is bound by the guano guarantee, and the part that relates to the decision of June 25, 1890 is amended and it is said that there is no need to change request regarding the rest. Tthe Court of Auditors should undertake settlement accounts that deposit and operate the wind.

General in accordance with specifications balances, that result from which acts by binding finish judgments, we order the disclosure and registration." ( Attorney-General Carlos Lamarca, Memoire, Ann. 10, Dreyfus. Doc. Fasc. IV, No. 252, p. 449. )

16. The order to liquidate the accounts of the Company contained in the Decree of September 19, 1892 was executed. The Court of Auditors examined and successively ruled the half remained contentious. Then, on the Order of the President of the Court, the book rose stripper act final settlement, taking basic judgments. Copy authentic Act, as contained in the records of the Tribunal under the date November 6, 1893 issued November 9, 1893 by Melito Najarro, Secretary of the Court, it follows from this document at July 31, 1893 the accounts of the Company presented in favor of its creditor balances creditor $7,026,653.38 U.S. gold dollars.

This balance is, as follows:

Capital: $4,246,464.07 (USD) to $1,447,612.51 (USD) = $3,298,851.56 (USD)

Interest: $5,957 (USD) from $581.09 (USD) to $2,229,779.27 (USD) = $3,727,801.82 (USD)

$7,026,653.38

At the foot of the Act include the following note:

NOTE. - It must be noted that the Company, whose claim has been liquidated, is obliged to make to the Government three thousand six hundred ( 3,600 ) certificates of [ one ] thousand ( $1,000 ) dollars [ USD ] each, and that if that devolution would only occur not their total value with their respective interests will escompter balance inferred from previous operations, amounting to sum of seven million twenty-six thousand six hundred fifty-three dollars and thirty-eight one-hundredeth [ $7,026,653.38 million (USD) ], Lima [ Peru ], November 6, 1893. ( Memoire, Attorney General Carlos Lamarca, Sch. 14. )

Based on the foregoing, the Company's agent has made application the claim that skills can create is delivered:

a) "Whether the money and deposit in Chile at the BANK OF ENGLAND on behalf of Peru's creditors must be given to the Company Plaintiff in full consideration of his claim against the State of Peru, or cons ( convincingly ) states of Peru and Chile debt amounting to seven million twenty-six thousand six hundred fifty-three dollars [ $7,026,653 million (USD) ] value at July 31, 1893."

The Company states make available to the Court of Arbitration:

1. All bonds of the Chile - Peru debt in 1866, with coupons, which included in the schedule annexed under Attorney General Carlos Lamarca, Memorie, No. 12.

2. The 3,600 certificates of $1,000 whose refund possible is ordered by the act of liquidation of November 6, 1893. ( Memoire, Lamarca, Sch. 4, p. 8. )

The Company also makes the following reservation:

"We declare reserve all our rights against the State of Peru and against the State of Chile for the portion of our debt that would not be recoverable on deposit in London [ BANK OF ENGLAND ]."

b) In its second ( 2nd ) memoir, page 81, line 8, the Company's agent concluded also by adherence to preliminary findings made by Dreyfus Frères Et Cie. (also known as) DREYFUS BROTHERS AND COMPANY, which they have more later waived:

"As far as the [ Switzerland Confederation ] France - Chile Arbitration Tribunal Orders that the State of Chile files BANK OF ENGLAND in the period to be determined by that Tribunal and available to it, the sum of £300,000 ( three hundred thousand pounds sterling ) subject to the Conclusion III Dreyfus Frères Et Cie. (aka) DREYFUS BROTHERS AND COMPANY, with interest at five per cent ( 5% ) per annum from January 1, 1896 days of filing;

"As far as the [ Switzerland Confederation ] Arbitral Tribunal orders that the State of Chile files BANK OF ENGLAND in the period to be determined by that Tribunal and available to it are the subject of the Conclusion IV Dreyfus Frères Et Cie. (aka) DREYFUS BROTHERS AND COMPANY, with interest at the rate of five per cent ( 5% ) per annum from January 1, 1896 the date of filing;

"The amount of these various sums to be awarded to the Plaintiff exclusively."

1. The Company's agent bases its claim on the liquidation made November 6, 1893 and November 9, 1893 by the Court of Accounts of Peru ( No. 16 above. ). Alternately, and in the event the Court of Arbitration does not take this decisive for liquidation, the Company offers to report proof of consistency in validity of its claim by producing of its books, all documents relating to the hearing before the Court of Auditors, and expertise ( Memoire I, p. 18-19 ).

2. The existence and validity of the claim agent of the Company have been the subject of a formal protest from any of Parties.

The government of Peru has declared rely Justice ( Memoire I, No. 392, p. 305), it admits, caveat on the question of law participate in the distribution of deposit, "the debt of the Company consignee of guano in the United States has been awarded by the Court of Accounts "( Ibid., No. 405, p. 313 ).

The PERUVIAN CORPORATION LIMITED does not deny nor admit the claim claimed. It [ PERUVIAN CORPORATION LIMITED ] believes that if the decisions of the Court of Auditors [ Switzerland Confederation France - Chile Arbitration Tribunal ] have been made after the occupation of Tarapaca [ Tarapacá, Chile ], the Arbitral Tribunal has the right to reconsider the issues it has decided.

The accounts had not been produced, it is impossible to form an opinion in this regard ( Memoire II, § 86, p. 149 ).

Participation of Mssr. Gautreau on behalf of Compagnie Financière Et Commerciale Du Pacifique ( Mem. II p. 133 ), Dreyfus Frères Et Cie. (aka) DREYFUS BROTHERS AND COMPANY ( Mem. II, p. 520 and 528 ) and the Société Générale Pour Favoriser Le Développement Du Commerce Et De L'Industrie (aka) SOCIETE GENERALE ( Mem. III, p. 28 ) is also placed on this latter point of view, raising some objections.

Dreyfus Frères Et Cie. (aka) DREYFUS BROTHERS AND COMPANY acknowledge however, that "except in exceptional circumstances, the recognition of the Peru Government on the claim of a creditor is evidence of sales of the same claim."

The Compagnie Financière Et Commerciale Du Pacifique ( Mem. II, p. 103 et seq. )

Philo Bernal, widow, et. al, do not discuss the amount of the debt claimed. ( by cons [ convincingly ], it is undisputed that the Company has qualified to appear as Plaintiff before the [ Switzerland Confederation ] Arbitration Tribunal [ Court of Auditors ] and to raise claims on deposit at the BANK OF ENGLAND, also challenged the merits, that the Company has no rights therein.

A. - On the first [ 1st ] point, the arguments of opponents can summarized as follows:

1. a) The PERUVIAN CORPORATION LIMITED has already raised the exception in its first ( 1st ) Memoire, p. 287 et seq.

The Company's agent, said the Corporation, a company is purely and exclusively Peru formed Peruvian citizens and banking houses, a commercial native itself, claims its nationality in the Memorandum submitted to arbitration.

However, Chile has made the deposit which is the subject of the trial for the benefit of foreign creditors of Peru, and the Court of Arbitration can know that these contradictory claims foreign creditors.

This results either in acts which constitute the compromise of the Treaty of Ancon, Errazuriz-Bacourt Protocol, Memorandum Federal Council, or the diplomatic correspondence between France, England, Chile, and Peru itself, the departmental reports and records of Chambers in Santiago, Chile and Lima, Peru.

The Arbitration Tribunal was established by Chile and two ( 2 ) states, France and England, whose citizens aggrieved by the Chilean conquest.

Peru has not given diplomatic support to Company it would do so as it could not, after accepted by the Treaty of Ancon, the new situation resulting from the conquest.

Only neutral powers are justified in asserting, among Chile, the claims of their nationals and to open them Court of Arbitration access.